(NPV, IRR, IRR, crossover point) Your firm is considering two projects with the following cash flows: a....

Question:

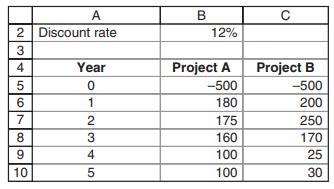

(NPV, IRR, IRR, crossover point) Your firm is considering two projects with the following cash flows:

a. If the appropriate discount rate is 12%, rank the two projects.

b. Which project is preferred if you rank by IRR?

c. Calculate the crossover rate, namely, the discount rate r at which the NPVs of both projects are equal.

d. Should you use NPV or IRR to choose between the two projects?

Give a brief discussion.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: