(Sunk costs) Your uncle is a proud owner of an up-market clothing store. Because business is down,...

Question:

(Sunk costs) Your uncle is a proud owner of an up-market clothing store.

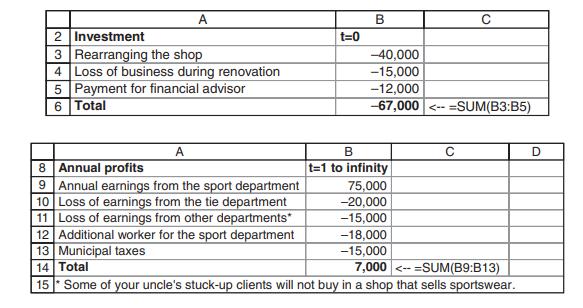

Because business is down, he is considering replacing the languishing tie department with a new sportswear department. In order to examine the profitability of such move, he has hired a financial advisor to estimate the cash flows of the new department. After 6 months of hard work, the financial advisor came up with the following calculation:

The discount rate is 12%, and there are no additional taxes. Thus the financial advisor calculated the NPV as follows: NPV = −67 000 + = − 7 000 0 12 , 8 667 , . , .

Your surprised uncle asked you (a promising finance student) to go over the calculation. After taking a close look, you identify two mistakes: (1) Although municipal taxes do not change as a result of the replacement of the tie department, the financial advisor has attributed part of existing municipal taxes to the cost of the store change. (2) The “Payment for financial advisor” will be paid even if we do not rearrange the shop. What are the correct NPV and IRR of the project?

Step by Step Answer:

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi