Amber Corporation reported the following summarized pretax data at the end of each year: Taxable income from

Question:

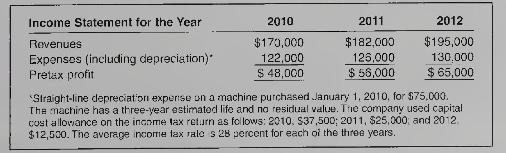

Amber Corporation reported the following summarized pretax data at the end of each year:

Taxable income from the income tax return was as follows: \(2010, \$ 32,000 ; 2011, \$ 56,000\); and \(2012, \$ 85,000\)

Required:

1. For each year, compute

(a) the income taxes payable and

(b) the deferred income tax. Is the deferred income tax a liability or an asset? Explain.

2. Show the tax-related amounts that should be reported each year on the income statement and the statement of financial position.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby

Question Posted: