ANALYZE TRANSACTIONS AND PREPARE FINANCIAL STATEMENTS. Several gta years ago, Mary Emerson founded Emerson Consulting, Inc., a

Question:

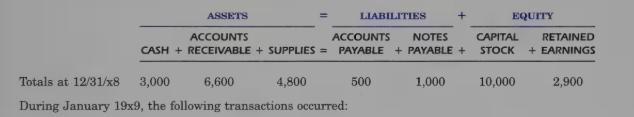

ANALYZE TRANSACTIONS AND PREPARE FINANCIAL STATEMENTS. Several gta years ago, Mary Emerson founded Emerson Consulting, Inc., a consulting business spe- 4 cializing in financial planning for young professionals. The following captions and amounts summarize Emerson Consulting’s balance sheet at December 31, 19x8, the beginning of the current year:

During January 19x9, the following transactions occurred:

a) Sold capital stock to a new stockholder in exchange for $2,000 cash.

b) Performed advisory services for a client for $1,550 and received the full amount in cash.

c) Received $750 on account from a client for whom services had been performed on credit.

d) Purchased supplies for $650 on credit.

e) Paid $500 on accounts payable. bi

f) Performed advisory services for $2,700 on credit.

g) Paid cash of $1,200 for secretarial services during January.

h) Paid cash of $800 for January’s office rent.

i) Used supplies during the month in the total amount of $900.

j) Paid a dividend of $400.

REQUIRED:

1. Record the effects of the transactions listed above on the accounting equation for the business. Use a format similar to the “Summary of Transaction Analysis” in Exhibit 1-3 in the chapter. Enter the totals at December 31, 19x9, in the first row of the summary, as shown above.

2. Prepare the balance sheet at January 31, 19x9, and the income statement, statement of changes in retained earnings, and statement of cash flows for the month of January 19x9.

Step by Step Answer: