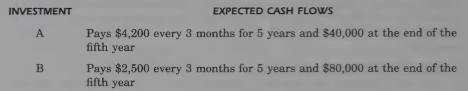

COMPARING INVESTMENTS. Max McPhee, a financial planner, is evaluating the following two investments for a client: REQUIRED:

Question:

COMPARING INVESTMENTS. Max McPhee, a financial planner, is evaluating the following two investments for a client:

REQUIRED:

1. Determine the present value of each investment if the client requires an interest (discount) rate of 8% compounded quarterly. Which investment should McPhee recommend to the client?

2. Determine the present value of each investment if the client requires an interest (discount) rate of 6% compounded quarterly. Which investment should McPhee recommend to the client?

3. What happens to the present value when the interest (discount) rate is decreased?

Why does this occur?

Suppose that investment B is significantly riskier than investment A, and the client is known to be reluctant to assume additional risk. Would this affect McPhee’s recommendations to the client under either required interest rate above?

Step by Step Answer: