CREDIT ANALYSES (LONG-TERM). Benninghoves Books sells college textbooks and supplies from a store near a major university.

Question:

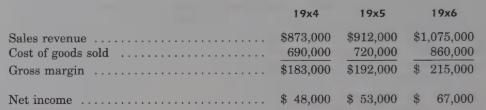

CREDIT ANALYSES (LONG-TERM). Benninghove’s Books sells college textbooks and supplies from a store near a major university. Benninghove’s has lost its lease and is seeking financing for the purchase of a store building. You have the following financial data for Benninghove’s Books for the past 3 years:

From other sources, you determine that the gross margin for college bookstores has averaged 15% of sales during the past 10 years and that the average gross margin percentage has been relatively stable during that period. Net income for bookstores has been approximately 4% of sales for the same period but has been below 4% of sales in each of the past 3 years. On the basis of this information and Benninghove’s data, would you be inclined to lend Benninghove’s Books the $400,000 necessary to purchase a new building? Why or why not? l01

Step by Step Answer: