Danier Leather Inc. (DL) is one of the largest publicly traded specialty leather apparel retailers in the

Question:

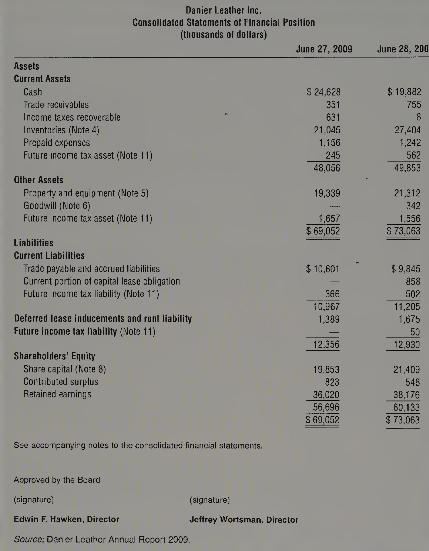

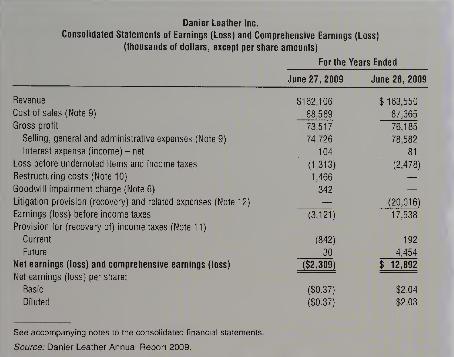

Danier Leather Inc. (DL) is one of the largest publicly traded specialty leather apparel retailers in the world. It designs, manufactures, and sells high-quality fashionable leather clothing and accessories to customers. Its products are sold in stores at shopping malls, through its corporate sales division, and online through its website, www.danier.com. Since entering the retail business in 1974, the company has produced a strong, long-term track record of growth and profits from continuing operations. DL's financial statements for 2008 and 2009 are shown on the next few pages.

\section*{Required:}

1. Examine DL's statements of financial position. Identify the four largest changes in the carrying amount of assets, liabilities, and shareholders' equity between the statement of financial position dates. What type of transactions could have caused the changes in the carrying amounts of these items?

2. The carrying amounts of the assets and liabilities reported on the company's statement of financial position reflect a mix of historical acquisition costs, amortized costs, and fair values. Refer to the notes to the company's financial statements for fiscal year 2009 that are available on the company's website (http://cnrp.marketwire.com/client/danier/ annualReports.jsp) and identify the valuation bases used by the company for financial reporting purposes.

3. Using information from the company's statements of financial position and income statement for 2009, can you determine the amount of cash flow generated from operations? If not, where can one find such information?

4. Compute the following ratios for fiscal years 2008 and 2009: debt-to-equity, total asset turnover, return on assets, return on equity, and net profit margin. Use the results of your computations to comment on the company's financial situation and profitability of its operations in both years. DL's total assets and shareholders' equity at June 24,2007 , amounted to \(\$ 81,746\) and \(\$ 48,709\), respectively.

5. Suppose that you are evaluating DL's financial statements for a potential investment in the company's shares. To what extent is the information contained in these financial statements relevant for your decision? What additional information would you require before making your Danier Leather decision?

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby