Esteban Almada was recently promoted to loan officer at First Federal Bank. He has authority to issue

Question:

Esteban Almada was recently promoted to loan officer at First Federal Bank. He has authority to issue loans up to $75,000 without approval from a higher bank official. This week two small companies, Dubrovnik Supplies, Inc., and Shimano Fashions, Inc., have each submitted a proposal for a six-month,

$75,000 loan. To prepare financial analyses of the two companies, Almada has obtained the information summarized below.

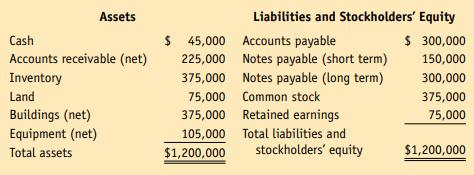

Dubrovnik Supplies, Inc., is a local lumber and home improvement company. Because sales have increased so much during the past two years, Dubrovnik Supplies has had to raise additional working capital, especially as represented by receivables and inventory. The $75,000 loan is needed to assure the company of enough working capital for the next year. Dubrovnik Supplies began the year with total assets of $1,110,000 and stockholders’

equity of $390,000. During the past year, the company had a net income of

$60,000 on net sales of $1,140,000. Dubrovnik Supplies’ unclassified balance sheet as of the current date appears as follows:

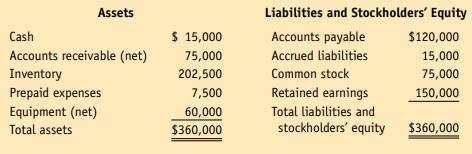

Shimano Fashions, Inc., has for three years been a successful clothing store for young professional women. The leased store is located in the downtown financial district. Shimano’s loan proposal asks for $75,000 to pay for stocking a new line of women’s suits during the coming season. At the beginning of the year, the company had total assets of $300,000 and total stockholders’ equity of $171,000. Over the past year, the company earned a net income of $54,000 on net sales of $720,000. The firm’s unclassified balance sheet at the current date is as follows:

1. Prepare a financial analysis of each company’s liquidity before and after receiving the proposed loan. Also compute profitability ratios before and after, as appropriate. Write a brief summary of the effect of the proposed loan on each company’s financial position.

2. Assume you are Esteban Almada and can make a loan to only one of these companies. Write a memorandum to the bank’s vice president outlining your decision and naming the company to which you would lend $75,000.

Be sure to state what positive and negative factors could affect each company’s ability to pay back the loan in the next year. Also indicate what other information of a financial or nonfinancial nature would be helpful in making a final decision.

Annual Report Case: CVS Corporation Classified Balance Sheet and Multistep Income Statement

Step by Step Answer: