Farkha, Sakhira and Sab are in partnership sharing profits and losses, Farkha 5/12, Sakhira 1/3 and Sab

Question:

Farkha, Sakhira and Sab are in partnership sharing profits and losses, Farkha 5/12, Sakhira 1/3 and Sab 1/4. On 1 September 2009 Sakhira retired from the partnership and at the same date Nazick was admitted to the partnership, introducing cash of €50,000. From this date, profits are to be shared equally between the three new partners and, in view of this, Sab agreed to pay a further €12,000 into the partnership as capital.

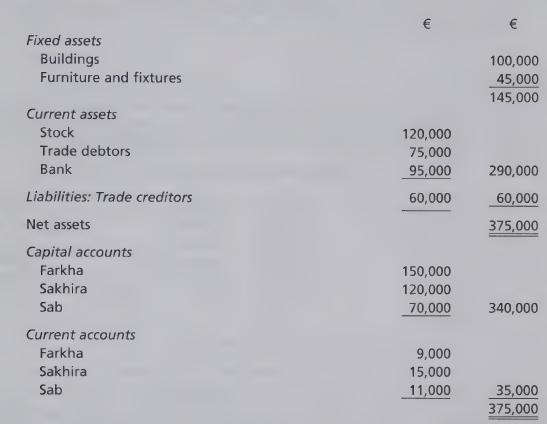

The balance sheet at 31 August 2009 is as follows:

The following adjustments should be made before preparing a revised opening balance sheet of the partnership on 1 September 2009:

a Goodwill of the partnership as at 31 August 2009 is agreed at €39,960. Goodwill is not to be included in the accounts.

Property is to be revalued at €120,000 and fixtures are to be revalued at €49,000.

Stock is considered to be shown at a fair market value in the accounts. A provision for doubtful debts of €1,708 is to be created.

Professional fees of €500 relating to the change in partnership structure are to be regarded as an expense of the year to 31st August 2009, but were not included in the profit and loss account of that year. They are expected to be paid in October 2009.

On retirement, Sakhira is to be paid a sum of €55,000. Sakhira has agreed to leave any remaining amount owing to her in the partnership as a loan. Sakhira’s loan carries interest of 12 percent per annum, and is to be repaid in full after two years.

All balances on current accounts are to be transferred to capital accounts. All balances on capital accounts in excess of €20,000 after this transfer are to be recorded in loan accounts carrying interest of 12 percent per annum.

Required 1 Prepare the partnership’s revaluation account.

2 Prepare the partnership’s bank account.

3 Prepare the partners’ capital accounts.

4 Prepare an opening balance sheet for the partnership on 1 September 2009, following completion of the above arrangements.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis