Financial faisenaton related to Pickerel Company ae the month ended June 30, 2008, is as follows: Net

Question:

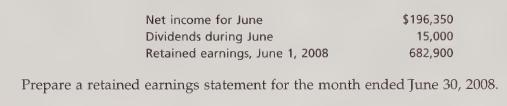

Financial faisenaton related to Pickerel Company ae the month ended June 30, 2008, is as follows:

Transcribed Image Text:

Net income for June $196,350 Dividends during June Retained earnings, June 1, 2008 15,000 682,900 Prepare a retained earnings statement for the month ended June 30, 2008.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting

ISBN: 9780324380675

10th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Question Posted:

Students also viewed these Business questions

-

Financial information related to Pickerel Company, a proprietorship, for the month ended June 30, 2008, is as follows: Net income for June ............. $196,350 Lynn Jepsens withdrawals during June...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Accounting for Inventories" Please respond to the following: As a Financial Accountant,determine the best type of income statement a retailer should use.Defend your suggestion. Analyze inventory...

-

Which of the following statements represent(s) how expenses affect equity? If expenses increase, then total equity decreases. If expenses decrease, then equity will decrease. Higher expenses result...

-

This year Monona Air Cleaners Inc. will pay a dividend on its stock of $6 per share. The following year the dividend is expected to be the same, increasing to $7 the year after. From that point on,...

-

In Exercises (a) find each point of discontinuity, (b) Which of the discontinuities are removable? not removable? Give reasons for your answers. - f(x) = (1-x, x-1 12. x = -1

-

* discuss transactional analysis as a way of understanding and planning interaction

-

Professor Schmidt, a geologist, has agreed to purchase McDonalds farm for a price of $2,000 per acre, which corresponds to the price of good quality farmland in the vicinity. However, Schmidt, on the...

-

The McGee Corporation finds it is necessary to determine its marginal cost of capital. McGees current capital structure calls for 50 percent debt, 20 percent preferred stock, and 30 percent common...

-

Giblet Services was organized on February 1, 2008. A summary of the revenue and expense transactions for February follows: Prepare an income statement for the month ended February 28. Fees earned...

-

From the Siena list a ee leced items taken set ie aeeotinet 5 ya Appliance Service as of a specific date, identify those that would appear on the balance sheet: 1. Accounts Payable 2. Cash 3. Fees...

-

Baucom Manufacturing Corporation was started with the issuance of common stock for $50,000. It purchased $7,000 of raw materials and worked on three job orders during 2012 for which data follow....

-

Q3. (a) Sketch and name the road structure layers including the bituminous coating layers. State the material's CBR value and the degree of compaction (DOC) for each road layer required by road works...

-

2. Justify the following in terms of impulse and momentum: a. Why are padded dashboards safer in automobiles?

-

The kidneys are an essential organ to regulating blood pressure in the cardiovascular system. Renal epithelial cells feature cilia on their surface, which allows them to sense blood flow in the...

-

Novak Corp. supplies its customers with high-quality canvas tents. These canvas tents sell for $170 each, with the following DM and DL usage and price expectations. Direct materials 9 square yards...

-

Develop a one-week schedule for your Housekeeping employees. Using the Excel spreadsheet that is attached above, you will prepare a schedule for the week The day-by-day occupied rooms forecast has...

-

Toto Company reports the following on its year-end balance sheet: Investment in held-to-maturity bonds, $6,500; Fund to retire long-term bonds payable, $7,750; Trademarks, $5,500; and Long-term...

-

Outline a general process applicable to most control situations. Using this, explain how you would develop a system to control home delivery staff at a local pizza shop.

-

Ventaz Corp manufactures small windows for back yard sheds. Historically, its demand has ranged from 30 to 50 windows per day with an average of 4646. Alex is one of the production workers and he...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

Study smarter with the SolutionInn App