Fiona and Frank have been in partnership for many years, sharing profits in the ratio 2:1. Fiona

Question:

Fiona and Frank have been in partnership for many years, sharing profits in the ratio 2:1. Fiona decides to retire from the partnership with effect from 31 August 2000 and Fred is admitted as a partner on that date. The new partnership of Frank and Fred will share profits in the ratio 3:1.

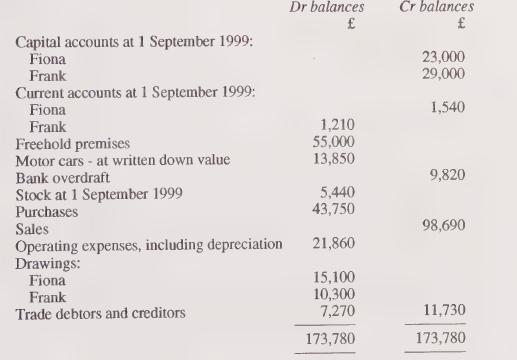

The trial balance of the partnership as at 31 August 2000, before Fiona's retirement and Fred's admission, is as follows:

Further information: 1. Fred contributes capital of 16,000 on his admission as a partner. 2. On her retirement, Fiona takes her motor car at its book value of 7,150. She also withdraws 10,000 in cash. The remainder of the amount owed to her is left in the partnership as a long-term loan. 3. The partners have agreed that the value of the closing stock on 31 August 2000 is 4,500 and that trade debtors of 550 should be written off. 4. The freehold premises are valued at 85,000 on 31 August 2000 but should continue to be shown at cost in the balance sheet. 5. Goodwill is valued at 24,000 on 31 August 2000 but should not be shown in the partnership balance sheet. Required:

(a) Prepare a trading and profit and loss account and an appropriation account for the year to 31 August 2000.

(b) Make the necessary entries to record Fiona's retirement and Fred's admission to the partnership.

(c) Prepare a balance sheet for the partnership of Frank and Fred after these entries have been made.

Step by Step Answer: