INVENTORY COSTING METHODS FOR 2 YEARS. Hartwell Products Company uses a periodic inventory system. For 19x1 and

Question:

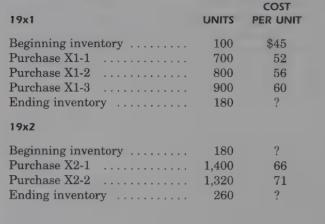

INVENTORY COSTING METHODS FOR 2 YEARS. Hartwell Products Company uses a periodic inventory system. For 19x1 and 19x2 Hartwell has the following data:

REQUIRED:

1. Compute 19x1 cost of goods sold and ending inventory using the FIFO, LIFO, weighted average, and specific identification methods. For the specific identification method assume that ending inventory is composed of 50 units from beginning inventory, 60 units from purchase X1-2, and 70 units from purchase X1-3.

2. Compute 19X2 cost of goods sold and ending inventory using the FIFO, LIFO, weighted average, and specific identification methods. For the specific identification method assume that ending inventory is composed of 30 units from 19x1 beginning inventory, 40 units from purchase X1-2, 100 units from purchase X2-1, and 90 units from purchase X2-2.

Step by Step Answer: