EFFECT OF INVENTORY COSTING METHODS ON TAXES. Elmwood Company sells lawn mowers to retail customers. Elmwood obtains

Question:

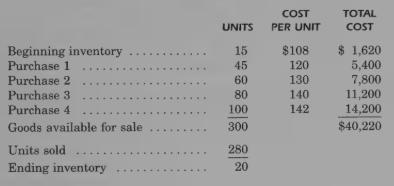

EFFECT OF INVENTORY COSTING METHODS ON TAXES. Elmwood Company sells lawn mowers to retail customers. Elmwood obtains the product directly from the manufacturer. Since lawn mowers are fairly bulky items, Elmwood had found it convenient to use the specific identification method of accounting. However, sales volume has increased and Elmwood is now considering a change in inventory method. Data for the current year, using the periodic system, are as follows:

REQUIRED:

1. Compute the cost of goods sold and the cost of ending inventory, using the FIFO, LIFO, and weighted average methods.

2. If Elmwood’s tax rate is 30%, how much cash would be saved in the current year by selecting the inventory method that produces the lowest gross margin relative to the other two methods? “

Step by Step Answer: