EFFECT OF PURCHASE TIMING WITH LIFO. Boston Oil Company sells heat- gt # ing vil to retail

Question:

EFFECT OF PURCHASE TIMING WITH LIFO. Boston Oil Company sells heat- gt #

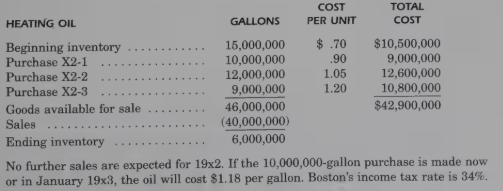

ing vil to retail customers in New England. In December 19x2, Boston is considering whether to purchase 10,000,000 gallons of home heating oil that it expects to sell early in 19x3. Boston can make the purchase now or defer it until late January 19x3. Boston uses a periodic inventory system and the LIFO method of accounting for inventory. The following data are available:

REQUIRED:

1. Compute the ending inventory and cost of goods sold for 19x2 assuming that the oil “ purchase is not made.

2. Compute the ending inventory and cost of goods sold assuming that the purchase is made.

Assume that storage and financing costs for the oil will be $645,000 larger if the purchase is made in December 19x2, rather than January 19x3. Do the tax savings arising from a December 19x2 purchase exceed the additional storage and financing costs?

Step by Step Answer: