EFFECTS OF INVENTORY REDUCTIONS. Alexander Petroleum Supply sells gasoline to independent service stations. Alexander has used the

Question:

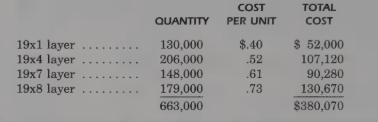

EFFECTS OF INVENTORY REDUCTIONS. Alexander Petroleum Supply sells gasoline to independent service stations. Alexander has used the LIFO method of accounting for its gasoline inventory for several years. You have the following data for the 19x9 beginning inventory:

Near the end of 19x9, Alexander’s gasoline supplier had a refinery breakdown. As a result, Alexander was unable to purchase enough gasoline to maintain its beginning inventory. In fact, Alexander had only 50,000 gallons on hand at December 31, 19x9.

Had the refinery been in operation, Alexander would have purchased sufficient gasoline so that ending inventory would have been 700,000 gallons.

REQUIRED:

1. If Alexander had purchased gasoline during 19x9 at $.81 per gallon, what would have been the effect on cost of goods sold of this unintended decline in inventory quantity?

2. Would the cost of goods sold have been affected by the inventory decline if FIFO had been in use?

3. If Alexander’s income tax rate is 34%, by how much have taxes changed because of the unintended decline in inventory?

Step by Step Answer: