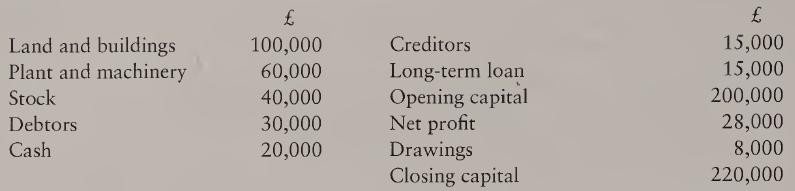

Janet Richards has the following financial details as at 31 December 2005. Required: Janet Richards balance sheet

Question:

Janet Richards has the following financial details as at 31 December 2005.

Required: Janet Richards’ balance sheet as at 31 December 2005.

Transcribed Image Text:

Land and buildings 100,000 Creditors 15,000 Plant and machinery 60,000 Long-term loan 15,000 Stock 40,000 Opening capital 200,000 Debtors 30,000 Net profit 28,000 Cash 20,000 Drawings 8,000 Closing capital 220,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Question 1 , Question 2 and Question 5 part (ii) thanks alot Faculty of Business, Economics & Accounting Department of Accounting and Finance HELP Bachelor of Business (Hons) Year 3 INTERNAL SUBJECT...

-

I need help for these questions. Thank you in advance Question 1 NUMBER ONE Baru Led., publishing and printing company, extracted the following trial balance as at 31 October 2005: Sh. '000" Sh....

-

I need help for these questions. Thank you in advance Question 1 NUMBER ONE Baru Led., publishing and printing company, extracted the following trial balance as at 31 October 2005: Sh. '000" Sh....

-

Given the financial data in the table below for two mutually exclusive alternatives, determine the value "X" for the two alternatives to be equally attractive. Use an interest rate of 12% per year. P...

-

Consider Panels B and D in Figure 16.4. Using the information in each panel, compute the share price at each node for each bond issue. In figure 16.4. Year Panel a) Firm assets 1.67 3.33 0,000.00...

-

1 What factors in the context of the company appear to shape your approach to managing change is your organisation seen as being receptive or non-receptive to change, for example, and what lies...

-

P19-2B Part One: In 20X3, Kelly Williams opened Kelly's Boutique, a small retail boutique selling makeup. On December 31, 20X4, her accounting records show the following: Required Inventory on...

-

The following is the pre closing trial balance for Allen University as of June 30, 2017. Additional information related to net assets and the statement of cash flows is also provided. Additional...

-

Swifty Inc. issues $4,100,000 of 7% bonds due in 10 years with interest payable at year-end. The current market rate of interest for bonds of similar risk is 10%. Click here to view factor tables...

-

Profit is the figure which links the profit and loss account and the balance sheet. Discuss.

-

Jill Jenkins has the following financial details as at 31 December 2005. Required: Jill Jenkins net current assets as at 31 December 2005. Stock 18,000 Cash 4,000 Debtors 8,000 Creditors 12,000

-

Reyes Company transfers out 12,000 units and has 2,000 units of ending work in process that are 25% complete. Materials are entered at the beginning of the process and there is no beginning work in...

-

You have two dashboards in the same workspace named Production and Manufacturing. Your company's Power BI administrator creates the following two dashboard data classifications: Medium Impact (MEDI)...

-

Question 2: Red Rocks Corporation was organized on September 1. Red Rocks encountered the following events during the first month of operations. a. Received $65,000 cash from the investors who...

-

he previous three weeks of data is below for the sales of sheds at SHEDS INC. Calculate the forecast for the next perioud (week 4) using a two period weighted moving average using weights of 3 and 2....

-

/3 3) ST tan(x) - In(cosx) dx What is the value of u? us dulcis) What is the corresponding value of du? du= 1-5mx dx cosx You must show all of your work in the space below to earn full credit. 9/3 So...

-

Please use the file which provides the data to answer the problems 1-3. Problem 1) The time Students entered the classroom of OM 390, Introductory Operations Management, was recorded by the professor...

-

Tucker Inc. produces high-quality suits and sport coats for men. Each suit requires 1.2 hours of cutting time and 0.7 hours of sewing time, uses 6 yards of material, and provides a profit...

-

In Exercises discuss the continuity of each function. f(x) -3 1 x - 4 y 3 2 -1 -2 -3+ 3 X

-

Choose two stocks from the same industry to minimize the influence of other confounding factors. You choose the industry that you are relatively more familiar with, and then estimate the implied...

-

why should Undertake research to review reasons for previous profit or loss?

-

A pension fund's liabilities has a PV01 of $200 million. The plan has $100 billion of assets with a weighted average modified duration of 8. The highest duration bond that the plan can invest in has...

Study smarter with the SolutionInn App