Japanese companies have historically relied more on debt financing and are more highly leveraged than U.S. companies.

Question:

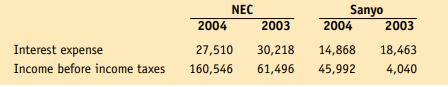

Japanese companies have historically relied more on debt financing and are more highly leveraged than U.S. companies. For instance, NEC Corporation and Sanyo Electric Co., two large Japanese electronics companies, had debt to equity ratios of about 4.7 and 4.2, respectively, in 2004.19 From the selected data from the companies’ annual reports shown in the table that follows (in millions of yen), compute the interest coverage ratios for the two companies for the two years.

Assume you are a financial analyst. Write a one-page memorandum that addresses the riskiness of these two companies and the trends they show.

Include in your memorandum a summary of the advantages and disadvantages of a debt-laden capital structure.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: