Provide a summary of the balance sheet / statement of operations common size analysis with the 5 ratios analysis and give insight on how the

Provide a summary of the balance sheet / statement of operations common size analysis with the 5 ratios analysis and give insight on how the company is overall performance and what can be done in the future if needed. See the attached for the common size analysis, below for the 5 ratio analysis.

Ratio 1: Current Ratio

Current Ratio = CR = CA/CL

Year 2=146,791/155,393 Year 1=161,580/142,266

=0.94 =1.14

- What does this ratio tell you?

Current ratio is a financial metric that helps understand a company's short-term liquidity and their ability to meet their short-term obligations with their short-term assets.

- Compute this ratio for Year 2:

Current ratio for year 2 is 0.94.

- In general, would you like this ratio to be higher or lower? Why?

In general, a company would like their current ratio to be higher due to this indicates that the company has more current assets than current liabilities which state that they can cover their short-term obligations. Also, a high current ratio could reflect inefficient use of resources, company may be holding to much cash or unfilled inventory.

- Trend Analysis: Compute this ratio for Year 1. Did the ratio get better or worse from year 1 to year 2?

Current ratio for year 1 is 1.14. Compared to year 2 current ratio of 0.94 the ratio has worsened. The company's short-term obligations have worsened.

- Industry Analysis: Estimates of industry averages for this ratio: How does the ratio compare with the industry?

Upper quartile | 2.6 |

|---|---|

Middle quartile | 1.8 |

Lower quartile | 1.4 |

The company's current ratio of 0.94 compared to the industry average falls below the lower quartile. The company's short-term liquidity is worse than the industry average.

- What are some risks or concerns if this ratio is TOO LOW?

Some risks or concerns with a too low current ratio are difficulty meeting short-term obligations. Which can potentially damage a company's creditworthiness and cause financial difficulties. Investor's may lose confidence in the company's ability to manage their finances. Also, the company may need to pay higher interest rates to borrow funds.

- What are some actions that could INCREASE this ratio?

Some actions that the company can do to increase the current ratio would be to paying down debt or delaying the payment of expenses. Selling inventory, collecting receivables, or raising additional capital.

- What are some risks or concerns if this ratio is TOO HIGH?

The company may be holding too much cash or unfilled inventory that can negatively impact their profitability.

- What are some actions that could DECREASE this ratio?

To decrease the current ratio the company may think about taking out additional loans or delaying the payment to suppliers. Also, increasing inventory levels to meet their anticipated sales growth.

- Why would this ratio be commonly considered as a key ratio at your organization, and in organizations in general?

Current ratio is a financial metric that is very useful for assessing a company's short-term financial health. Which provides valuable insight into the company's ability to meet their short-term obligations and manage their working capital effectively. Ratio is very important for investors, creditors, and management.

- What actions and/or decisions (if any) in your operational area/unit could influence this ratio?

Inventory management can improve the current ratio, efficiently managing inventory levels can reduce the amount of short-term assets associated with inventory. Also, arranging better payment terms with suppliers can extend payment deadlines.

Ratio 2: Debt to Equity

Debt to Equity = total debt / total equity

Year 2 = 316,632/146,043 Year 1 = 282,304/138,245

= 2.17 = 2.04

- What does this ratio tell you?

Debt to equity ratio is a financial metric that helps measure the degree to which a company is financing their operations with debt rather than their own resources. Indicating the extent to which a company is relying on borrowed funds to finance their operations and growth.

- Compute this ratio for Year 2:

Debt to equity ratio for year 2 is 2.17.

- In general, would you like this ratio to be higher or lower? Why?

In general, a company would like their debt-to-equity ratio to be lower. It indicates that the company has a lower level of financial risk. The company has a higher proportion of equity financing which considers them more stable and less risky.

- Trend Analysis: Compute this ratio for Year 1. Did the ratio get better or worse from year 1 to year 2?

Debt to equity for year 1 is 2.04. Compared to year 2 debt to equity of 2.17 the ratio increased. The company has relied more on debt financing relative to equity financing. Therefore, the change from year 1 to year 2 worsened.

- Industry Analysis: Estimates of industry averages for this ratio: How does the ratio compare with the industry?

Upper quartile | 2.4 |

|---|---|

Middle quartile | 0.78 |

Lower quartile | 0.33 |

The company's debt to equity of 2.17 compared to the industry is higher than the industry's middle quarter which reflects the company has a higher debt to equity ratio compared to industry average.

- What are some risks or concerns if this ratio is TOO LOW?

Some concerns for debt to equity ratio being too low may be that the company is not utilizing debt financing opportunities. A low ratio indicates that the company may have missed growth opportunities. Being more dependent on equity financing which can result in their ability to leverage debt for expansion or investment.

- What are some actions that could INCREASE this ratio?

Some actions that the company can do to increase the debt to equity ratio would be to take on additional debt through loans or bonds. Restructuring the capital structure to increase the proportion of debt.

- What are some risks or concerns if this ratio is TOO HIGH?

Some concerns if the debt to equity is too high is that the company has a high level of leverage and is heavily dependent on debt financing. Which increases the financial risk and liability of the company.

- What are some actions that could DECREASE this ratio?

To decrease the debt to equity the company should think about repaying debt using available cash. Possibly raising additional equity capital through stock issuance. Or even selling off some of their assets to reduce debt.

- Why would this ratio be commonly considered as a key ratio at your organization, and in organizations in general?

The debt-to-equity ratio would be commonly considered as a key ratio for a company due to it provides an understanding of the financial health of the company, their capital structure, and risk profile. This is used by investors, creditors, and stakeholders to access the company's ability to meet their financial obligations. It is a great indicator of the company's financial stability and ability to resist economic challenges.

- What actions and/or decisions (if any) in your operational area/unit could influence this ratio?

Actions and/or decisions in your operational/unit that could influence the debt to equity ratio may be deciding if the company should finance projects or investments using debt or equity. Implementing strategies to decrease debt or increase equity. This may involve improving profitability and attracting new investors.

Ratio 3: Net Profit Margin

Net Profit Margin = net income / total revenues

Aka Return on Sales

Year 2 = (2,722)/513,983 Year 1 = 33,364/469,822

= -0.0053 = 0.0710

- What does this ratio tell you?

Net profit margin also known as net margin, is a financial metric used to calculate the percentage of profit a company produces from its total revenue. Measures the amount of net profit a company obtains per dollar of revenue gained.

- Compute this ratio for Year 2:

Net profit margin ratio for year 2 is -0.0053.

- In general, would you like this ratio to be higher or lower? Why?

In general, a company would like their net profit margin ratio to be higher. Due to this indicates that a larger amount of revenue is converted into profit.

- Trend Analysis: Compute this ratio for Year 1. Did the ratio get better or worse from year 1 to year 2?

Net profit margin for year 1 is 0.0710. Compared to year 2 net profit margin of -0.0053, the ratio worsened.

- Industry Analysis: Estimates of industry averages for this ratio: How does the ratio compare with the industry?

Upper quartile | 4.9% |

|---|---|

Middle quartile | 1.5 |

Lower quartile | 0.5 |

The company's net profit margin of -0.0053 compared to the industry is lower. This may reflect that the company is less efficient in translating revenue to profit.

- What are some risks or concerns if this ratio is TOO LOW?

Some concerns for net profit margin ratio being too low may be that the company is having difficulty in covering operational expenses, in addition to financial instability.

- What are some actions that could INCREASE this ratio?

Some actions that the company can do to increase the net profit margin ratio make operations more efficient to decrease expenses. Also, increasing sales through new project to increase their income.

- What are some risks or concerns if this ratio is TOO HIGH?

A concern if the net profit margin ratio is too high is the company could be fixating on short-term profits at the expense of long-term expansion.

- What are some actions that could DECREASE this ratio?

Some actions that could decrease the net profit margin ratio could be investing in research, development, and marketing. Or even monitor their competitors pricing and adjust their own prices accordingly.

- Why would this ratio be commonly considered as a key ratio at your organization, and in organizations in general?

The net profit margin ratio would be commonly considered as a key ratio for a company due to it provides how well the company is able to convert revenue into profit. This is very useful for investors to access the company's profitability.

- What actions and/or decisions (if any) in your operational area/unit could influence this ratio?

Actions and/or decisions in your operational/unit that could influence the net profit margin ratio could be the operational efficiency. Managing the daily decisions on cost control and revenue generation.

Ratio 4 : Return on Assets

Return on Assets = net income / total assets

Year 2 = (2,722)/462,675 Year 1 = 33,364/420,549

= -0.0059 = 0.0793

- What does this ratio tell you?

Return on assets is a financial metric that indicates a company's profitability in relation to their total assets. Reflects how efficiently the company is utilizing their assets to generate income.

- In general, would you like this ratio to be higher or lower? Why?

In general, a company would like their return in assets ratio to be higher. This indicates that the company is generating more profit from their available resources.

- Compute this ratio for Year 2:

Return on asset ratio for year 2 is -0.0059.

- Trend Analysis: Compute this ratio for Year 1. Did the ratio get better or worse from year 1 to year 2?

Return on asset for year 1 is 0.0793. Compared to year 2 return on assets of -0.0059 the ratio has drastically decreased.

- Industry Analysis: Estimates of industry averages for this ratio: How does the ratio compare with the industry?

Upper quartile | 10% |

|---|---|

Middle quartile | 3.3 |

Lower quartile | 1.3 |

The company's return on assets of -0.0059 is significantly low compared to the industry average.

- What are some risks or concerns if this ratio is TOO LOW?

Some concerns for return on assets ratio being too low would be that there can be difficulty raising capital. Investors may pause to invest in a company with such a low ratio. Resulting in the company finding it difficult to obtain financing for growth and expansion. A major concern would be that the company may need to depend on debt financing to cover expenses, which can result to higher financial risks.

- What are some actions that could INCREASE this ratio?

Some actions that can be taken to increase the return on asset ratio would be selling non-performing assets. Eliminating assets that do not generate sufficient return can improve profitability. Also, reducing costs by eliminating unnecessary expenses.

- What are some risks or concerns if this ratio is TOO HIGH?

Some concerns if the return on asset ratio is too high is that the company may be giving up long-term stability for short-term gains which can cause financial instability in the future. The company may be engaging in risky business practices in hopes of higher profits.

- What are some actions that could DECREASE this ratio?

To decrease the return on asset ratio by making payment towards debt. This will improve the company's financial health and reduce interest expenses. Also, investing in research and development, groundwork, new employees may for the present time reduce the return on asset ratio but benefiting the company for a long period.

- Why would this ratio be commonly considered as a key ratio at your organization, and in organizations in general?

The return on asset ratio would be commonly considered as a key ratio for a company due to it provides a detailed understanding of how well a company is managing their assets and generating profit. This is also used for comparisons between different companies and industries.

- What actions and/or decisions (if any) in your operational area/unit could influence this ratio?

Actions and/or decisions in your operational/unit that could influence the return on asset ratio may be identifying and implementing cost saving measures that can help improve efficiency and profitability. Also, finding ways to increases sales and revenue will directly contribute to increasing the return on asset.

Ratio 5: Return on Equity

Return on Equity = net income / total equity

Year 2 = (2,722)/146,043 Year 1 = 33,364/138,245

= -0.0186 = 0.2413

- What does this ratio tell you?

Return on equity is a financial metric that measure the profitability of a company with regards to their equity.

- Compute this ratio for Year 2:

Return on equity ratio for year 2 is 0.2413.

- In general, would you like this ratio to be higher or lower? Why?

In general, a company would like their return on equity to be higher. It indicates that the company is generating more profit per unit of equity.

- Trend Analysis: Compute this ratio for Year 1. Did the ratio get better or worse from year 1 to year 2?

Return on equity for year 1 is 0.2413. Compared to year 2 return on equity of -0.0186 the ratio has drastically decreased.

- Industry Analysis: Estimates of industry averages for this ratio: How does the ratio compare with the industry?

Upper quartile | 12.5% |

|---|---|

Middle quartile | 5.2 |

Lower quartile | 3.5 |

The company's return on equity of -0.0186 compared to the industry average is below.

- What are some risks or concerns if this ratio is TOO LOW?

Some concerns for return on equity ratio being too low would be poor financial performance and inability to generate sufficient profit from the equity invested. Affecting the company's ability to attract investors and can cause a decline in stock value.

- What are some actions that could INCREASE this ratio?

Some actions that can be taken to increase the return on equity ratio would be to improve operational efficiencies, reducing expenses, and improve the use of assets.

- What are some risks or concerns if this ratio is TOO HIGH?

Some concerns if the return on equity ratio is too high is that the company may be depending on debt, which can result in financial instability and increased financial risk.

- What are some actions that could DECREASE this ratio?

To decrease the return on equity ratio company can make payments on their debt. Also, improving efficiency to decrease the costs.

- Why would this ratio be commonly considered as a key ratio at your organization, and in organizations in general?

The return on equity ratio would be commonly considered as a key ratio for a company due to it provides understanding of how effectively the company is utilizing their equity to generate profit. This financial metric is very useful to creditors, investors, and management which reflect the company's financial health and performance.

- What actions and/or decisions (if any) in your operational area/unit could influence this ratio?

Actions and/or decisions in your operational/unit that could influence the return on equity ratio may be repaying debt, or even possibly refinancing debt for a lower interest rate if possible.

Ratio 9: Cash Flow Statement

Cash Flow Statement Ratios = Cash Flow from Operations (CFO) relative to other items, such as:

Note: CFO = top category of CF Statement.

Year 2 | Year 1 | |

CFO / Revenue = | 46,752/513,983= 0.0910 | 46,327/469,822= 0.0986 |

CFO / Operating Income = | 46,752/12,248= 3.8171 | 46,327/24,879= 1.8621 |

CFO / Total Assets = | 46,752/462,675= 0.1010 | 46,327/420,549= 0.1102 |

CFO / Total Equity = | 46,752/146,043= 0.3201 | 46,327/138,245= 0.3351 |

CFO / Total Debt = | 46,752/316,632= 0.1477 | 46,327/282,304= 0.1641 |

- In general terms, what do these ratios & ratios like these tell you?

CFO / Revenue ratio indicates the proportion of cash flow from operations related to the company's revenue. Reflecting how efficiently the company generates cash from their business activity.

CFO / Operating Income ratio measures the cash flow from operations related to the operating income. Reflecting the ability of the company to translate their operating income into cash.

CFO / Total Assetsratio indicates the cash flow from operations related to the total assets of the company. Providing an understanding of the efficiency of the company generating cash compared to their assets.

CFO / Total Equityratio measures the cash flow from operations related to the total equity of the company. Reflecting the company's ability to generate cash in connection with the shareholder's investment.

CFO / Total Debtratio shows the cash flow from operations related to the total debt of the company. Reflecting the company's ability to generate cash to meet their debt obligations.

- In general, would you like these ratios to be higher or lower? Why?

In general, higher ratios are more desired. Due to indicating the company has better financial health and efficiency. The company generates more cash from their operations.

- Compute these ratios for Years 1 & 2 in the columns above:

See chart above.

- Trend Analysis: In general terms, did the ratios generally get better or worse?

Some of the cash flow statement ratios got better and others worse. Revenue ratio decreased. Operating income ratio increased by double of year 1. Total assets ratio decreased. Total equity ratio decreased. Total debt ratio decreased. Increase reflects the company is showing improvement from prior year cash flow generation. Decrease reflects the company has decreased in their cash flow efficiency.

- Industry Analysis: Why would it be valuable to evaluate how a firm's CFO ratios (such as the ones above) compare with the industry averages for the ratios?

Comparing a firm's CFO ratios with industry averages provides an understanding on how the company is performing compared to their competitors.

- What are some risks or concerns if these ratios are TOO LOW?

If the CFO ratios are too low, there is a concern that there may be an issue with inadequate cash flow generation and the possibility of not meeting financial obligations.

- What are some actions that could INCREASE these ratios?

Some actions that can increase CFO ratios would be to focus on raising their cash flow from operations. This could occur by increasing sales, decreasing operating expenses, and improving operation efficiency.

- What are some risks or concerns if these ratios are TOO HIGH?

If the CFO ratios are too high, there is a concern that the company is not investing in growth opportunities and not handling their capital structure properly.

- What are some actions that could DECREASE these ratios?

Some actions that can decrease CFO ratios would be to invest in growth opportunities, paying off their debt.

- Why would these ratios be commonly considered as key ratios at your organization, and in organizations in general?

The CFO ratios would be commonly considered as a key ratio for a company due to it provides understanding of how the company is performing, their cash flow generation, and their overall financial health.

- What actions and/or decisions (if any) in your operational area/unit could influence these ratios?

Actions and/or decisions in your operational/unit that could influence the CFO ratios by improving operational efficiencies, making the right investment decisions, and increase the company's cash flow generation.

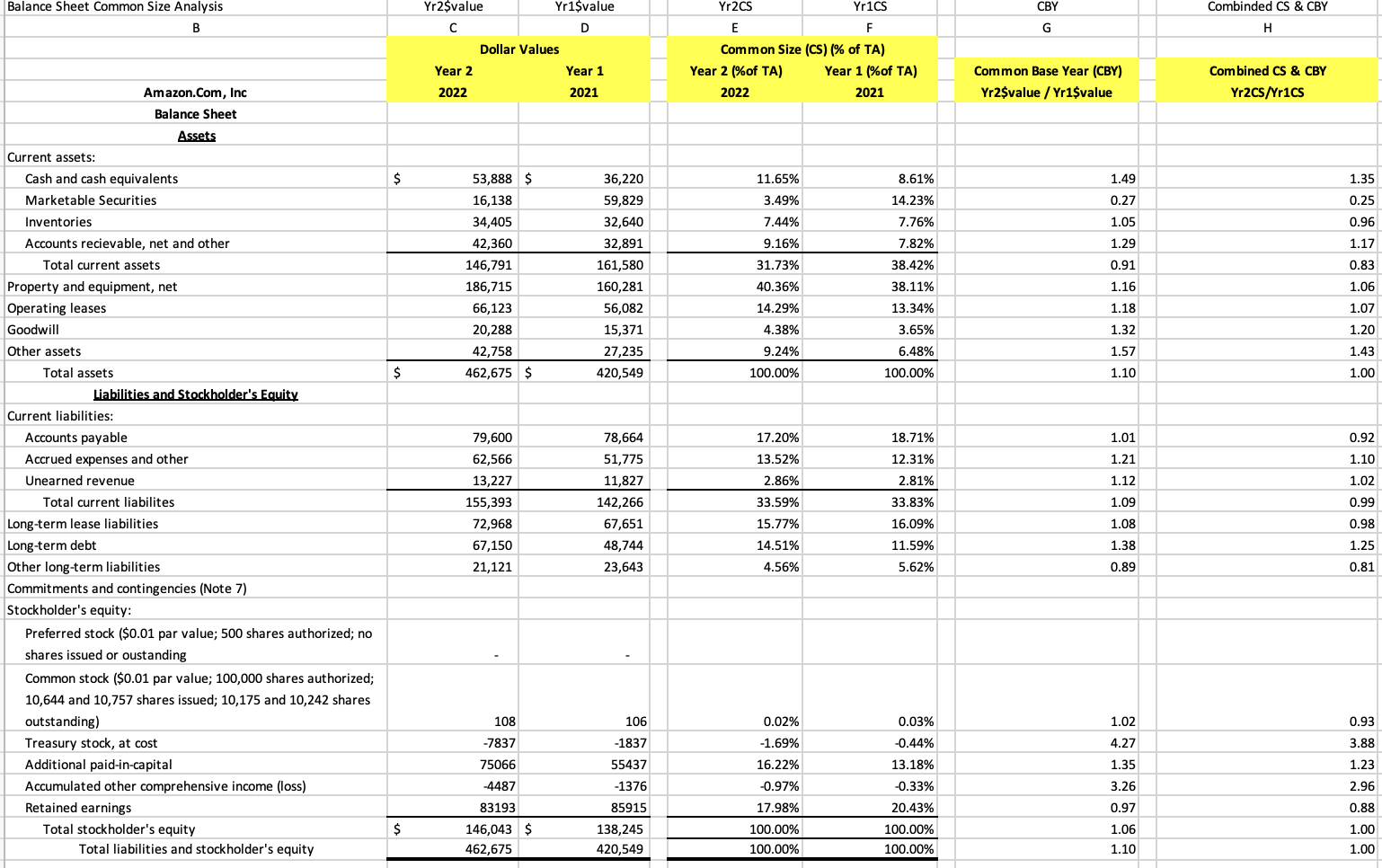

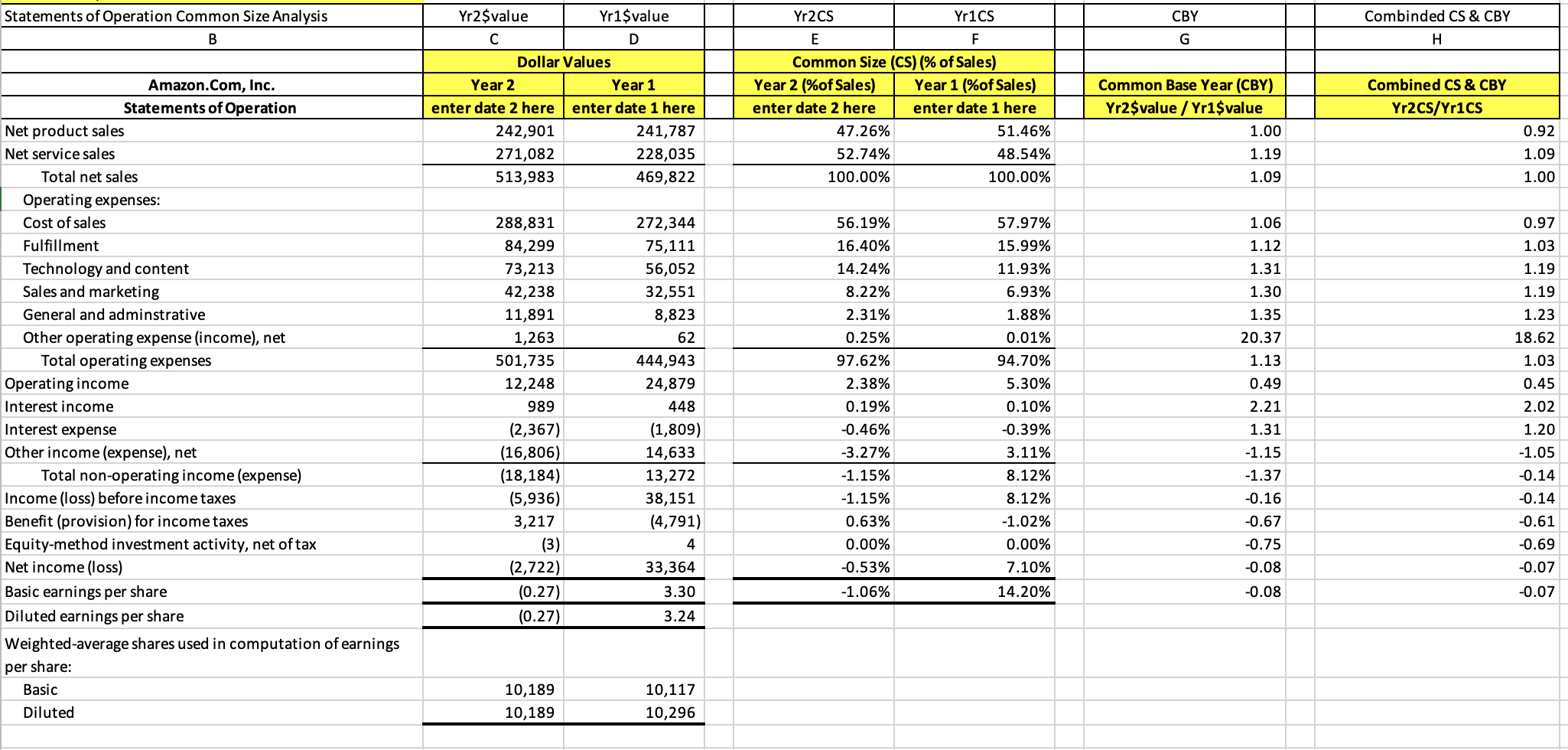

Balance Sheet Common Size Analysis B Current assets: Yr2$value Year 2 Amazon.com, Inc 2022 Balance Sheet Assets Dollar Values Yr1$value D Yr2CS E Yr1CS F Common Size (CS) (% of TA) Year 1 Year 2 (% of TA) 2021 2022 CBY G Combinded CS & CBY H Year 1 (%of TA) 2021 Common Base Year (CBY) Yr2$value / Yr1$value Combined CS & CBY Yr2CS/Yr1CS Cash and cash equivalents Marketable Securities $ 53,888 $ 36,220 11.65% 8.61% 1.49 1.35 16,138 59,829 3.49% 14.23% 0.27 0.25 Inventories 34,405 32,640 7.44% 7.76% 1.05 0.96 Accounts recievable, net and other Total current assets 42,360 32,891 9.16% 7.82% 1.29 1.17 146,791 161,580 31.73% 38.42% 0.91 0.83 Property and equipment, net 186,715 160,281 40.36% 38.11% 1.16 1.06 Operating leases 66,123 56,082 14.29% 13.34% 1.18 1.07 Goodwill 20,288 15,371 4.38% 3.65% 1.32 1.20 Other assets 42,758 27,235 9.24% 6.48% 1.57 1.43 Total assets $ 462,675 $ 420,549 100.00% 100.00% 1.10 1.00 Liabilities and Stockholder's Equity Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilites Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) 79,600 78,664 17.20% 18.71% 1.01 0.92 62,566 51,775 13.52% 12.31% 1.21 1.10 13,227 11,827 2.86% 2.81% 1.12 1.02 155,393 142,266 33.59% 33.83% 1.09 0.99 72,968 67,651 15.77% 16.09% 1.08 0.98 67,150 48,744 14.51% 11.59% 1.38 1.25 21,121 23,643 4.56% 5.62% 0.89 0.81 Stockholder's equity: Preferred stock ($0.01 par value; 500 shares authorized; no shares issued or oustanding Common stock ($0.01 par value; 100,000 shares authorized; 10,644 and 10,757 shares issued; 10,175 and 10,242 shares outstanding) 108 106 0.02% 0.03% 1.02 0.93 Treasury stock, at cost Additional paid-in-capital -7837 -1837 -1.69% -0.44% 4.27 3.88 75066 55437 16.22% 13.18% 1.35 1.23 Accumulated other comprehensive income (loss) Retained earnings -4487 -1376 -0.97% -0.33% 3.26 2.96 83193 85915 17.98% 20.43% 0.97 0.88 Total stockholder's equity $ 146,043 $ 138,245 100.00% 100.00% 1.06 1.00 Total liabilities and stockholder's equity 462,675 420,549 100.00% 100.00% 1.10 1.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started