Matt Stiner started a delivery service, Stiner Deliveries Ltd., on June 1, 2025. The following transactions occurred

Question:

Matt Stiner started a delivery service, Stiner Deliveries Ltd., on June 1, 2025. The following transactions occurred during the month of June.

June 1 Shareholders invested £10,000 cash in the business in exchange for ordinary shares.

2 Purchased a used van for deliveries for £14,000. Matt paid £2,000 cash and signed a note payable for the remaining balance.

3 Paid £500 for office rent for the month.

5 Performed services worth £4,800 on account.

9 Declared and paid £300 in cash dividends.

12 Purchased supplies for £150 on account.

15 Received a cash payment of £1,250 for services performed on June 5.

17 Purchased gasoline for £100 on account.

20 Received a cash payment of £1,500 for additional services performed.

23 Made a cash payment of £500 on the note payable.

26 Paid £250 for utilities.

29 Paid for the gasoline purchased on account on June 17.

30 Paid £1,000 for employee salaries.

Instructions

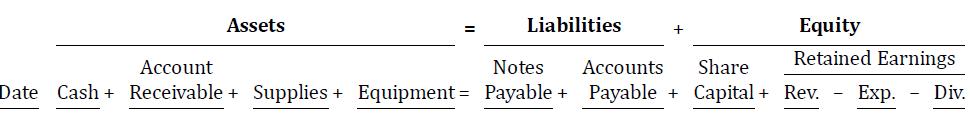

a. Show the effects of the above transactions on the accounting equation using the following format.

Include margin explanations for any changes in the Retained Earnings account in your analysis.

b. Prepare an income statement for the month of June.

c. Prepare a statement of financial position at June 30, 2025.

Determine financial statement amounts and prepare retained earnings statement.

Step by Step Answer:

Financial Accounting With International Financial Reporting Standards

ISBN: 9781119787051

5th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso