MULTIYEAR EFFECTS OF ALTERNATIVE INVENTORY COSTING METHODS. Coverly Supply Company has the following data for 19x5 and

Question:

MULTIYEAR EFFECTS OF ALTERNATIVE INVENTORY COSTING METHODS.

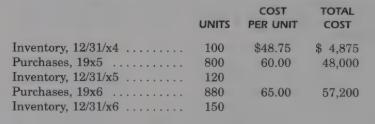

Coverly Supply Company has the following data for 19x5 and 19x6:

REQUIRED:

1. Compute ending inventory and cost of goods sold for 19x5 and 19x6, using the FIFO, LIFO, and weighted average methods.

2. If Coverly’s tax rate is 25%, how much cash is saved in 19x5 and 19x6 by using LIFO relative to FIFO and weighted average?

3. Why are the beginning inventory amounts for 19x6 different for each of the three . methods?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: