Pappas Corporation began operations in January 2012. The charter authorized the following share capital: Preferred shares: 9

Question:

Pappas Corporation began operations in January 2012. The charter authorized the following share capital:

Preferred shares: 9 percent, \(\$ 25\) par value, authorized 80,000 shares.

Common shares: no par value, authorized 160,000 shares.

During 2012, the following transactions occurred in the order given:

a. Issued 40,000 common shares to each of the three organizers. Collected \(\$ 9\) cash per share from two of the organizers, and received a plot of land with a small building on it in full payment for the shares of the third organizer and issued the shares immediately. Assume that 30 percent of the non-cash payment received applies to the building.

b. Sold 4.800 preferred shares at \(\$ 25\) per share. Collected the cash and issued the shares immediately.

c. Sold 4,000 preferred shares at \(\$ 25\) and 2,000 common shares at \(\$ 12\) per share. Collected the cash and issued the shares immediately.

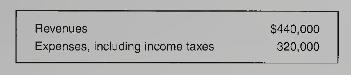

d. The operating results at the end of 2012 were as follows:

\section*{Required:}

1. Prepare the journal entries to record each of these transactions and to close the accounts.

2. Write a brief memo explaining how you determined the cost of the land and the building in the first journal entry.

3. Prepare the shareholders' equity section of the statement of financial position for Pappas Corporation as at December 31, 2012.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby