Profit is to be evaluated under four different situations as follows: i. Prices are rising: Situation A-FIFO

Question:

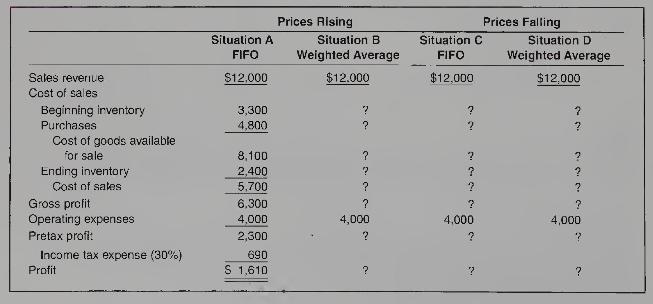

Profit is to be evaluated under four different situations as follows:

i. Prices are rising:

Situation A-FIFO is used. Situation B-Weighted average is used.

ii. Prices are falling:

Situation C-FIFO is used. Situation D-Weighted average is used.

The basic data common to all four situations are sales, 500 units for \(\$ 12,000\); beginning inventory, 300 units; purchases, 400 units; ending inventory, 200 units; and operating expenses, \(\$ 4,000\). The following tabulated income statements for each situation have been set up for analytical purposes:

Required:

1. Complete the preceding tabulation for each situation. In Situations \(A\) and \(B\) (prices rising), assume the following: beginning inventory, 300 units at \(\$ 11=\$ 3,300\); purchases, 400 units at \(\$ 12=\$ 4,800\). In Situations C and D (prices falling), assume the opposite; that is, beginning inventory, 300 units at \(\$ 12=\$ 3,600\); purchases, 400 units at \(\$ 11=\$ 4,400\). Use periodic inventory procedures.

2. Analyze and discuss the relative effects on pretax profit and on profit as demonstrated by (1) when prices are rising and when prices are falling.

3. Discuss the relative effects, if any, on the cash position for each situation.

4. Would you recommend FIFO or weighted average? Explain.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby