RONA Inc. (www.rona.ca), founded in 1939, is Canada's leading distributor and retailer of hardware, home improvement, and

Question:

RONA Inc. (www.rona.ca), founded in 1939, is Canada's leading distributor and retailer of hardware, home improvement, and gardening products. It has a network that exceeds 600 stores across Canada. Its sales grew from \(\$ 478\) million in 1993 to \(\$ 4,677\) million in 2009 . 1ts financial Required:

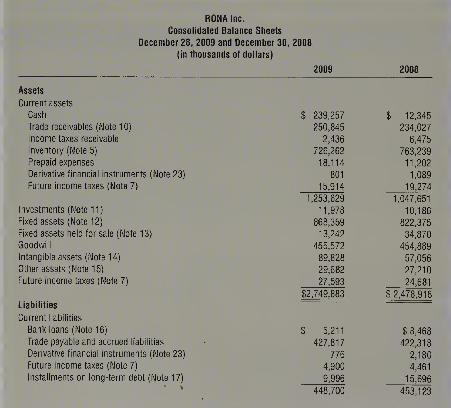

1. Examine RONA's balance sheets. Why did the company's assets increase significantly in 2009 ? Which sections of the annual reports would include information that helps the reader answer this question? Which assets show the largest increases, and how did the company finance the increase in these assets?

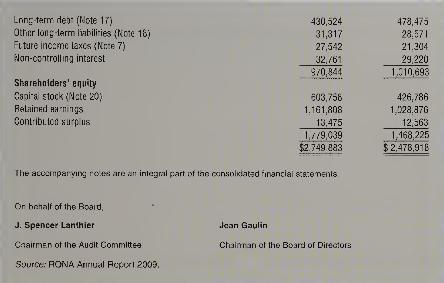

2. Compute and interpret the debt-to-equity ratios for 2008 and 2009.

3. RONA's current assets include a Prepaid expenses account with a balance of \(\$ 18,114\). What does this account represent, and what type of transactions would cause an increase or a decrease in the account balance? Explain.

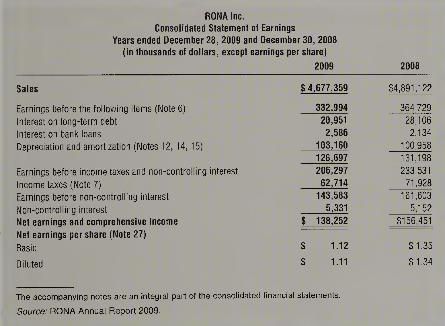

4. RONA's income statement does not include information related to cost of sales and general, selling, and administrative expenses. Why did the company exclude such details from its income statement? Explain.

5. Compute the total asset turnover ratio, return on assets, return on equity, and net profit margin for both years 2008 and 2009. Comment on the profitability of RONA's operations in both years. RONA's total assets and shareholders' equity at December 31,2007 , amounted to \(\$ 2,482,446\) and \(\$ 1,325,206\), respectively.

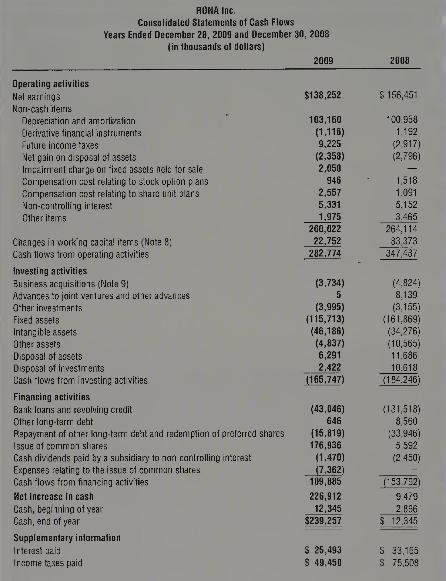

6. RONA's operations generated significant amounts of cash during both the years 2008 and 2009 . The company also made significant investments in 2009 . How did the company finance these investments?

7. Compute and interpret the quality of earnings ratio for both 2008 and 2009:"

8. Access one of the online information services listed in the chapter, search for RONA Inc. (RON.TO) and look for analyst estimates. What is the average analysts' estimate of RONA's earnings per share (EPS) for the next two years? Do analysts expect RONA's EPS to increase or decrease in the future? What information did the analysts take into consideration in computing their EPS estimates for the next two years?

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby