Selected financial information for Frank Corporation is presented below. Selected 2011 Transactions: a. Purchased investment securities for

Question:

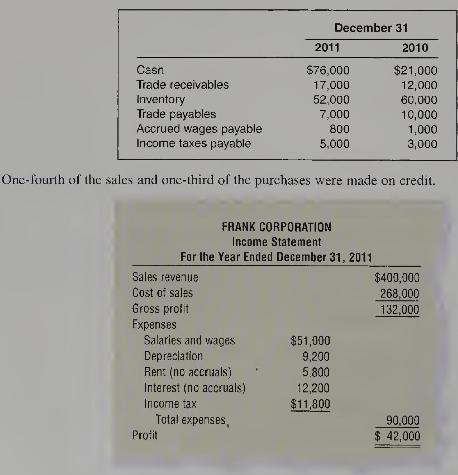

Selected financial information for Frank Corporation is presented below.

Selected 2011 Transactions:

a. Purchased investment securities for \(\$ 5,000\) cash.

b. Borrowed \(\$ 15,000\) on a two-year, 8 percent interest-bearing note.

c. During 2011, sold machinery for its carrying amount; received \(\$ 11,000\) in cash.

d. Purchased machinery for \(\$ 50,000\); paid \(\$ 9,000\) in cash and signed a four-year note payable to the dealer for \(\$ 41,000\).

e. Declared and paid a cash dividend of \(\$ 10,000\) on December 31, 2011.

Selected account balances at December 31, 2010 and 2011 are as follows:

Required:

1. Prepare a statement of cash flows for the year ended December 31, 2011. Use the indirect method to compute the cash flows from operating activities. Include any additional required note disclosures.

2. Compute and explain the quality of earnings ratio and the capital acquisitions ratio.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby