Answered step by step

Verified Expert Solution

Question

1 Approved Answer

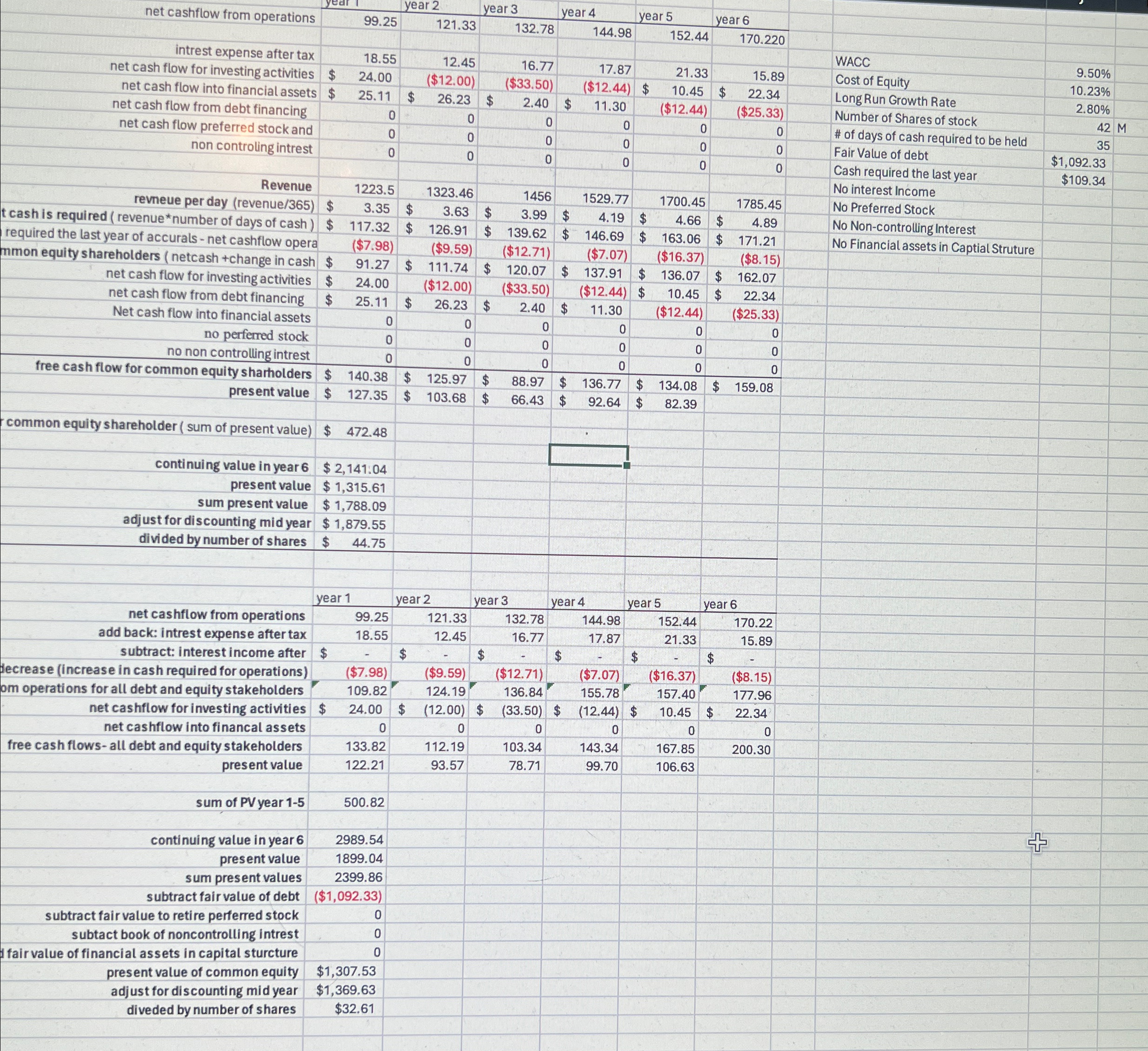

year year 2 year 3 year 4 year 5 net cashflow from operations 99.25 121.33 132.78 144.98 152.44 year 6 170.220 WACC 9.50% intrest

year year 2 year 3 year 4 year 5 net cashflow from operations 99.25 121.33 132.78 144.98 152.44 year 6 170.220 WACC 9.50% intrest expense after tax 18.55 12.45 16.77 net cash flow for investing activities $ net cash flow into financial assets $ net cash flow from debt financing 24.00 ($12.00) ($33.50) 17.87 ($12.44) $ 21.33 15.89 Cost of Equity 10.23% 10.45 $ 22.34 Long Run Growth Rate 2.80% 25.11 $ 26.23 $ $ 2.40 $ 11.30 ($12.44) ($25.33) Number of Shares of stock 42 M 0 0 0 0 0 0 # of days of cash required to be held 35 net cash flow preferred stock and non controling intrest 0 0 0 0 0 0 Fair Value of debt $1,092.33 0 0 0 0 0 0 Cash required the last year $109.34 No interest Income Revenue 1223.5 1323.46 1456 1529.77 1700.45 1785.45 revneue per day (revenue/365) $ t cash is required (revenue*number of days of cash) $ required the last year of accurals - net cashflow opera mmon equity shareholders (netcash +change in cash $ net cash flow for investing activities $ net cash flow from debt financing Net cash flow into financial assets no perferred stock 3.35 $ 117.32 $ ($7.98) 91.27 $ 24.00 3.63 $ 3.99 $ 4.19 $ 126.91 $ 139.62 $ ($9.59) ($12.71) 111.74 $ 120.07 $ 146.69 $ 4.66 $ 163.06 $ 4.89 No Non-controlling Interest 171.21 No Preferred Stock No Financial assets in Captial Struture ($7.07) ($16.37) ($8.15) 137.91 $136.07 $ 162.07 ($12.00) ($33.50) ($12.44) $ 10.45 $ 22.34 $ 25.11 $ 26.23 $ 2.40 $ 11.30 ($12.44) ($25.33) 0 0 0 0 0 0 0 0 0 0 0 0 no non controlling intrest 0 0 0 0 0 0 free cash flow for common equity sharholders $ 140.38 $ 125.97 $ present value $ 127.35 $ 103.68 $ 88.97 $ 66.43 $ 136.77 $ 134.08 $ 159.08 92.64 $ 82.39 common equity shareholder (sum of present value) $ 472.48 continuing value in year 6 $2,141.04 present value $ 1,315.61 sum present value $ 1,788.09 adjust for discounting mid year $1,879.55 divided by number of shares $ 44.75 year 1 year 2 year 3 year 4 year 5 year 6 net cashflow from operations 99.25 add back: intrest expense after tax subtract: interest income after $ decrease (increase in cash required for operations) om operations for all debt and equity stakeholders net cashflow for investing activities $ net cashflow into financal assets free cash flows-all debt and equity stakeholders 18.55 121.33 12.45 132.78 16.77 144.98 17.87 152.44 21.33 170.22 15.89 $ $ $ $ ($7.98) 109.82 24.00 $ (12.00) $ ($9.59) 124.19 ($12.71) ($7.07) ($16.37) ($8.15) 136.84 (33.50) $ 155.78 (12.44) $ 157.40 10.45 $ 177.96 22.34 0 0 0 0 0 0 133.82 112.19 103.34 143.34 167.85 200.30 present value 122.21 93.57 78.71 99.70 106.63 sum of PV year 1-5 500.82 continuing value in year 6 2989.54 present value 1899.04 sum present values subtract fair value of debt subtract fair value to retire perferred stock subtact book of noncontrolling intrest fair value of financial assets in capital sturcture present value of common equity adjust for discounting mid year 2399.86 ($1,092.33) 0 0 0 $1,307.53 $1,369.63 diveded by number of shares $32.61 +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started