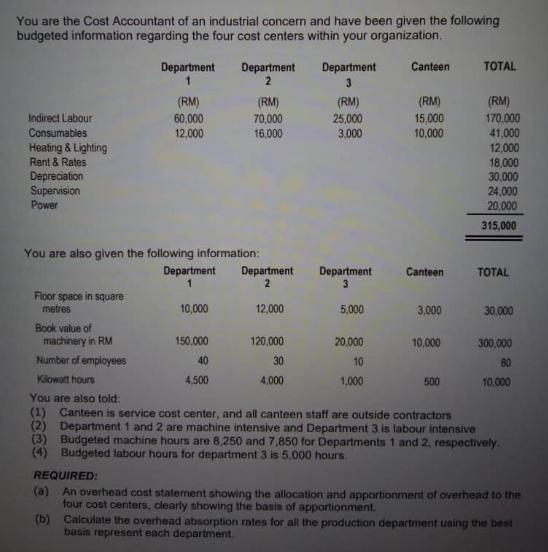

You are the Cost Accountant of an industrial concern and have been given the following budgeted information regarding the four cost centers within your

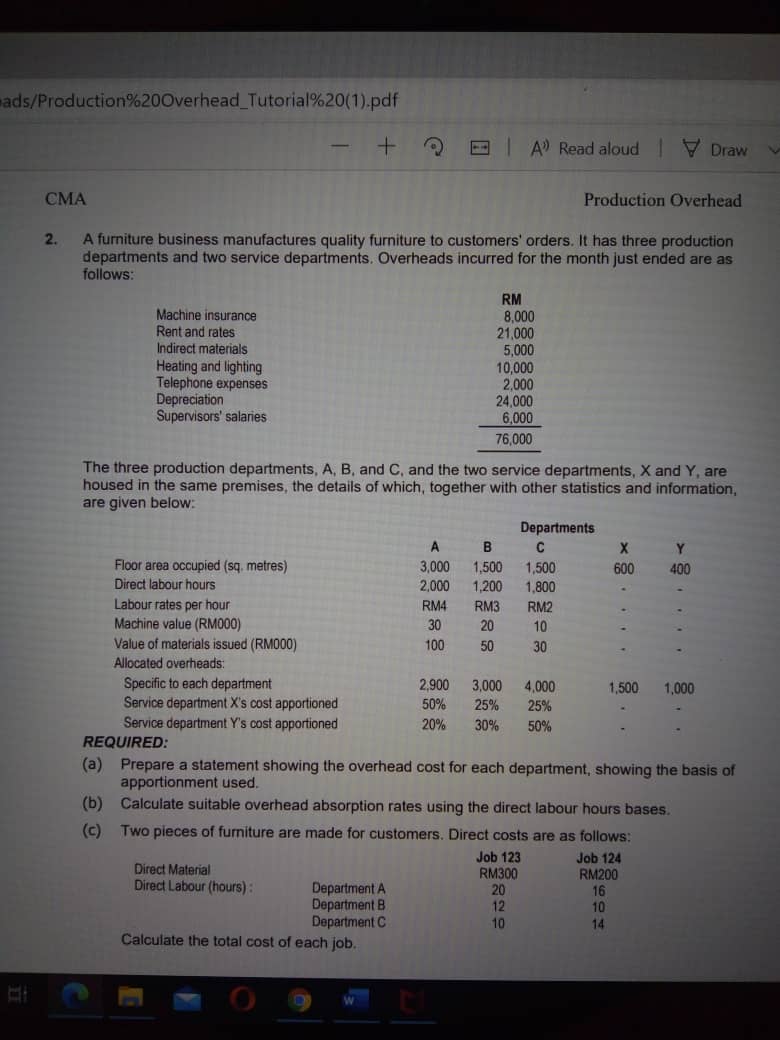

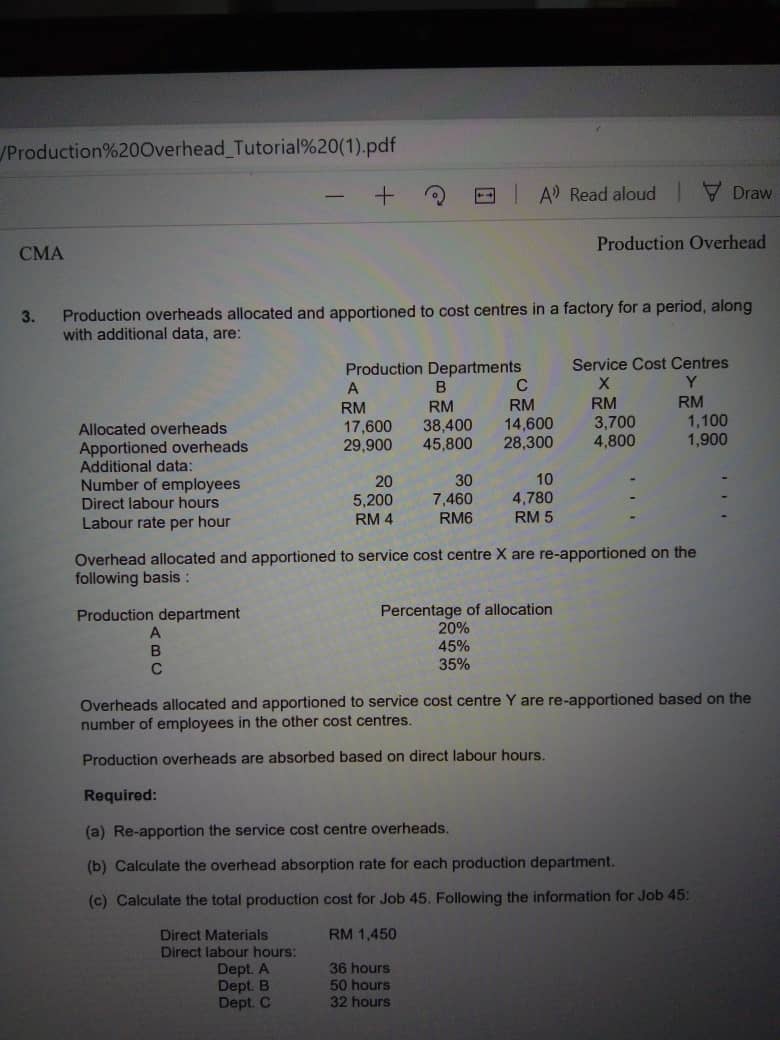

You are the Cost Accountant of an industrial concern and have been given the following budgeted information regarding the four cost centers within your organization. Department Department Department Canteen TOTAL 2 3 (RM) (RM) (RM) (RM) (RM) Indirect Labour 60,000 70,000 25,000 15,000 170,000 Consumables 12,000 16,000 3,000 10,000 41,000 Heating & Lighting 12,000 Rent & Rates 18,000 Depreciation 30,000 Supervision Power 24,000 20,000 315,000 You are also given the following information: Department Department Department Canteen TOTAL 1 2 3 Floor space in square metres 10,000 12,000 5,000 3,000 30.000 Book value of machinery in RM 150,000 120,000 20,000 10,000 300,000 Number of employees 40 30 10 80 Kilowatt hours 4,500 4,000 1,000 500 10,000 You are also told: (1) Canteen is service cost center, and all canteen staff are outside contractors (2) Department 1 and 2 are machine intensive and Department 3 is labour intensive (3) Budgeted machine hours are 8,250 and 7,850 for Departments 1 and 2, respectively. (4) Budgeted labour hours for department 3 is 5,000 hours. REQUIRED: (a) An overhead cost statement showing the allocation and apportionment of overhead to the four cost centers, clearly showing the basis of apportionment. (b) Calculate the overhead absorption rates for all the production department using the best basis represent each department. ads/Production%20Overhead Tutorial%20(1).pdf E CMA 2. + A Read aloud Draw Production Overhead A furniture business manufactures quality furniture to customers' orders. It has three production departments and two service departments. Overheads incurred for the month just ended are as follows: Machine insurance Rent and rates Indirect materials Heating and lighting Telephone expenses Depreciation Supervisors' salaries RM 8,000 21,000 5,000 10,000 2,000 24,000 6,000 76,000 The three production departments, A, B, and C, and the two service departments, X and Y, are housed in the same premises, the details of which, together with other statistics and information, are given below: A B Departments C Floor area occupied (sq. metres) 3,000 1,500 1,500 600 400 Direct labour hours 2,000 1,200 1,800 Labour rates per hour RM4 RM3 RM2 Machine value (RM000) 30 20 10 Value of materials issued (RM000) 100 50 30 Allocated overheads: Specific to each department 2,900 3,000 4,000 1,500 1,000 Service department X's cost apportioned 50% 25% 25% Service department Y's cost apportioned 20% 30% 50% REQUIRED: (a) Prepare a statement showing the overhead cost for each department, showing the basis of apportionment used. (b) Calculate suitable overhead absorption rates using the direct labour hours bases. (c) Two pieces of furniture are made for customers. Direct costs are as follows: Direct Material Direct Labour (hours): Job 123 Job 124 RM300 RM200 Department A Department B Department C 2200 16 12 10 10 14 Calculate the total cost of each job. Production%20Overhead Tutorial%20(1).pdf CMA 3. + | A Read aloud Draw Production Overhead Production overheads allocated and apportioned to cost centres in a factory for a period, along with additional data, are: Production Departments Service Cost Centres A B C X Y RM RM RM RM RM Allocated overheads 17,600 38,400 14,600 3,700 1,100 Apportioned overheads 29,900 45,800 28,300 4,800 1,900 Additional data: Number of employees 20 30 10 Direct labour hours 5,200 7,460 4,780 Labour rate per hour RM 4 RM6 RM 5 Overhead allocated and apportioned to service cost centre X are re-apportioned on the following basis: Production department A Percentage of allocation 20% 45% 35% B C Overheads allocated and apportioned to service cost centre Y are re-apportioned based on the number of employees in the other cost centres. Production overheads are absorbed based on direct labour hours. Required: (a) Re-apportion the service cost centre overheads. (b) Calculate the overhead absorption rate for each production department. (c) Calculate the total production cost for Job 45. Following the information for Job 45: Direct Materials RM 1,450 Direct labour hours: Dept. A 36 hours Dept. B 50 hours Dept. C 32 hours

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Cost Centers and Overhead Allocation Problem 1 Prepare an overhead cost statement showing the allocation and apportionment of overhead to the four c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started