Silk Company bought a machine for ($ 65,000) cash. The estimated useful life was five years, and

Question:

Silk Company bought a machine for \(\$ 65,000\) cash. The estimated useful life was five years, and the estimated residual value was \(\$ 5,000\). Assume that the estimated useful life is 150,000 units. Units actually produced were 45,000 in year 1 and 40,000 in year 2.

Required:

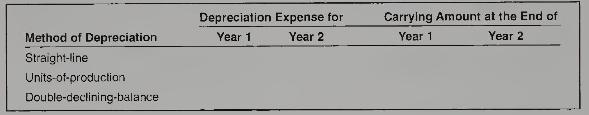

1. Determine the appropriate amounts to complete the following schedule. Show computations, and round to the nearest dollar.

2. Which method would result in the lowest earnings per share for year 1? For year 2?

3. Which method would result in the highest amount of cash outflows in year 1 ? Why?

4. Indicate the effects of

(a) acquiring the machine and

(b) recording annual depreciation on the operating and investing activities on the statement of cash flows for year 1. Assume that straightline depreciation is used.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby