The accounting year-end of Phillipps Ltd is on 31 May. On 31 May 2008 the business had

Question:

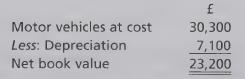

The accounting year-end of Phillipps Ltd is on 31 May. On 31 May 2008 the business had the following balances on its motor vehicles account:

Motor vehicles are depreciated using the straight-line method at a rate of 20 percent per annum and using the proportionate method of calculating the depreciation charge in the year of acquisition, but no charge is made in the year of disposal.

The profits or losses on the disposal account are written up on the last day of each accounting year.

The following transactions occurred during 2008-09:

• On 31 August, the business purchased a delivery truck for £10,300.

• On 30 September, the business purchased an estate car for a salesperson for £11,100.

Also, the business sold a saloon car for £750 which was originally bought on 1 June 2004 for £3,150 (at cost).

• On 30 November, the business sold a minibus for £1,290 which was originally bought on 30 November 2005 for £9,800 (at cost).

• On 31 January, the business purchased a van for £9,900. The van was second-hand and originally cost £14,900.

• On 28 February, the business sold a pick-up truck for £1,680 which was originally bought on 1 March 2006 for £4,900 (at cost).

Required

Show the double entries relating to the motor vehicles, depreciation expense, provision for depreciation and disposal accounts.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis