Mr Flo Rida owns a small factory and uses the reducing balance method of depreciation for plant,

Question:

Mr Flo Rida owns a small factory and uses the reducing balance method of depreciation for plant, with a 60 percent write off each year, and maintains a plant account to record all entries concerning the plant.

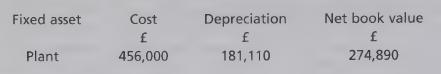

An extract from the balance sheet as at 31 July 2008 is as follows:

The plant T-account is as follows:

Plant purchased on 19 February 2005 for £80,000 was sold for £1,250 on 10 November 2008.

New plant was purchased for cash on 16 June 2009 for £110,000.

The business’s policy is to charge a full year’s depreciation in the year of acquisition, but none in the year of sale.

Required Show the double-entries relating to plant, depreciation expense, provision for depreciation, and disposal accounts for the year to 31 July 2009. Use the blank T-accounts provided below.

Step by Step Answer:

Financial Accounting A Practical Introduction

ISBN: 9780273714293

1st Edition

Authors: Ilias Basioudis