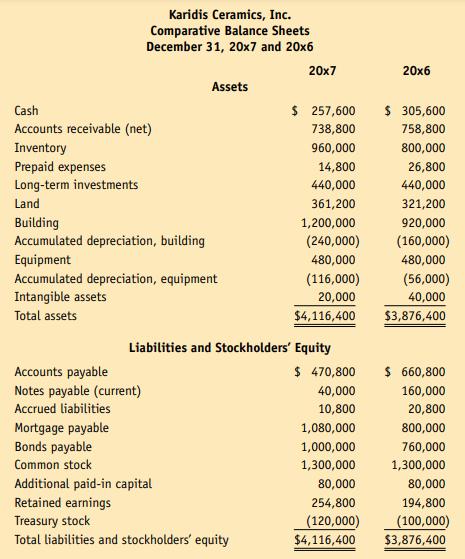

The comparative balance sheets for Karidis Ceramics, Inc., for December 31, 20x7 and 20x6 are presented on

Question:

The comparative balance sheets for Karidis Ceramics, Inc., for December 31, 20x7 and 20x6 are presented on the next page. During 20x7, the company had net income of $96,000 and building and equipment depreciation expenses of $80,000 and $60,000, respectively. It amortized intangible assets in the amount of $20,000; purchased investments for $116,000; sold investments for $150,000, on which it recorded a gain of $34,000; issued

$240,000 of long-term bonds at face value; purchased land and a warehouse through a $320,000 mortgage; paid $40,000 to reduce the mortgage;

borrowed $60,000 by issuing notes payable; repaid notes payable in the amount of $180,000; declared and paid cash dividends in the amount of

$36,000; and purchased treasury stock in the amount of $20,000.

Required 1. Using the indirect method, prepare a statement of cash flows for Karidis Ceramics, Inc.

2. User Insight: Why did Karidis Ceramics experience a decrease in cash in a year in which it had a net income of $96,000? Discuss and interpret.

3. User Insight: Compute and assess cash flow yield and free cash flow for 20x7. Why is each of these measures important in assessing cash-generating ability?

Step by Step Answer: