THE EFFECT OF ADJUSTMENTS ON THE FINANCIAL STATEMENTS. John Day, owner of several rental properties, has prepared

Question:

THE EFFECT OF ADJUSTMENTS ON THE FINANCIAL STATEMENTS. John Day, owner of several rental properties, has prepared his 19x8 financial statements.

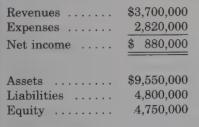

They are summarized as follows:

Your examination of the financial statements indicates that Mr. Day has overlooked several items that are likely to affect the accounts:

a) Depreciation is unrecorded for an apartment building with a cost of $1,400,000, an expected life of 20 years, and a residual value of $200,000.

b) Interest accrued on a $1,200,000, 9.5% note payable is unrecorded for the period August 1 through December 31.

c) Wage expense for December in the amount of $13,750 is unpaid and unrecorded at year-end.

d) Rent revenue in the amount of $127,000 was earned during December but was neither collected nor recorded at year-end.

e) Rent revenue in the amount of $67,700 was earned during December but was not recognized at year-end. The revenue was collected in advance and recorded as unearned revenue.

REQUIRED:

1. Prepare the omitted adjusting entries.

2. Determine the effect of these omitted adjusting entries on the income statement amounts (revenues, expenses, and net income) and on the balance sheet amounts (assets, liabilities, and equity).

Step by Step Answer: