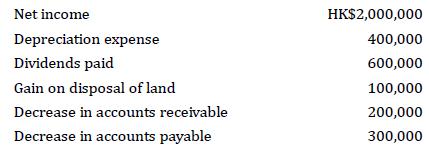

The following data are available for Allen Clapp Ltd. Net cash provided by operating activities is: a.

Question:

The following data are available for Allen Clapp Ltd.

Net cash provided by operating activities is:

a. HK$1,600,000.

b. HK$2,200,000.

c. HK$2,400,000.

d. HK$2,800,000.

Transcribed Image Text:

Net income Depreciation expense Dividends paid Gain on disposal of land Decrease in accounts receivable Decrease in accounts payable HK$2,000,000 400,000 600,000 100,000 200,000 300,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

The correct answer is b HK2200000 Net cash provided b...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Financial Accounting With International Financial Reporting Standards

ISBN: 9781119787051

5th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Business questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The unclassified balance sheet accounts for Sorkin Corporation, which is a public company using IFRS, for the year ended December 31, 2011, and its statement of comprehensive income and statement of...

-

The Aurora Fund received equipment having a cost of $65,000 and a fair value of $50,000 as a gift. The donor states that the Fund should decide how to best use the gift. How should the gift be...

-

Though the McDonalds (MCD) menu of hamburgers, cheeseburgers, the Big Mac, Quarter Pounder, Filet-O-Fish, and Chicken McNuggets is easily recognized, McDonalds financial statements may not be as...

-

The vice-president of marketing, Carol Chow, thinks that her firm can increase sales by 15,000 units for each $5-per-unit reduction in its selling price. The company's current selling price is $90...

-

What obstacles to efficiency does optional health insurance create? President Obama campaigned on a health-care reform plan that did not include mandatory health insurance. Hillary Clinton wanted...

-

Decide which method of data collection you would use to gather data for each study. Explain your reasoning. (a) A study on the effect of low dietary intake of vitamin C and iron on lead levels in...

-

Antikron Company produces rubber seals used in the aerospace industry. Standards call for 4 pounds of material at $3.50 per pound for each seal. The standard cost for labor is .6 hours at $21 per...

-

Ratio analysis: calculate and analyze key financial ratios in each ratio category, including liquidity, profitability, activity, and solvency. Interpret the ratios to identify the company's strengths...

-

Recife Company completed its first year of operations on December 31, 2025. Its initial income statement showed that Recife had revenues of R\($195,000\) and operating expenses of R\($78,000.\)...

-

Cassandra SAs comparative statements of financial position are presented below. Additional information: 1. Net income was 23,300. Dividends declared and paid were 14,600. 2. Equipment that cost...

-

refine your ideas to clarify your research topic?

-

Arizona Corp. had the following account balances at 12/1/19: Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional...

-

Construct a 90% confidence interval for the population standard deviation o at Bank A. Bank A 4.2 5.4 5.9 6.1 6.6 7.7 7.7 8.6 9.3 10.0

-

Margin of Error For the poll described in Exercise 1, describe what is meant by the statement that "the margin of error was given as +3.5 percentage points."

-

1) Explain what the critical issue was in the Uber decisions in the First Circuit (Culliane case), and the Second Circuit (Myer case), and how each court, looking at the same facts, came to opposite...

-

IFRS LEASE 1. Kappa Berhad enters into a 10-year lease on 1 January 2020. Kappa Berhad incurred the following costs in respect of the lease: RM2,500 legal fees RM15,000 deposit made at the...

-

In Year 2, Adams Corporation discovered that it forgot to accrue interest expense of $40,000 in Year 1. This overstatement of pretax income w as material. The related income tax effect of this error...

-

Chapter 9 Stock Valuation at Ragan Engines Input area: Shares owned by each sibling Ragan EPS Dividend to each sibling Ragan ROE Ragan required return Blue Ribband Motors Corp. Bon Voyage Marine,...

-

A company sells two products. Assuming the same sales mix as shown below, how many units of Product A must be sold to breakeven? Product A Product B Total Units 100,000 150,000 250,000 Sales $300,000...

-

South Sea Baubles has the following (incomplete) balance sheet and income statement. BALANCE SHEET AT END OF YEAR (Figures in $ millions) Assets 2015 2016 Liabilities and Shareholders' Equity 2015...

-

When the investor pays $100,000 to acquire 40% of a company's outstanding voting shares at a time when the fair value of the company's net assets are $175,000, the resulting goodwill amount is...

Study smarter with the SolutionInn App