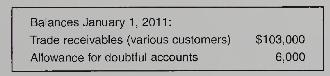

The following data were selected from the records of Fluwars Company for the year ended December (31,2011).

Question:

The following data were selected from the records of Fluwars Company for the year ended December \(31,2011\).

The company sold merchandise for cash and on open account with credit terms \(1 / 10, n / 30\). Assume a unit sales price of \(\$ 400\) in all transactions and use the gross method to record sales revenue.

Transactions during 2011:

a. Sold merchandise for cash, \(\$ 128,000\).

b. Sold merchandise to Abbey Corp; invoice amount, \(\$ 7,600\).

c. Sold merchandise to Brown Company; invoice amount, \(\$ 14,000\).

d. Abbey paid the invoice in

(b) within the discount period.

e. Sold merchandise to Cavendish Inc.; invoice amount, \(\$ 9,200\).

f. Two days after paying the account in full, Abbey returned four defective units and received a cash refund.

g. Collected \(\$ 99,000\) cash from customers for credit sales made in 2011, all within the discount periods.

h. Three days after the purchase date, Brown returned three of the units purchased in

(c) and received account credit.

i. Brown paid its account in full within the discount period.

j. Sold merchandise to Decca Corporation; invoice amount, \(\$ 7,000\).

k. Cavendish paid its account in full after the discount period.

l. Wrote off an old account of \(\$ 1,400\) after deciding that the amount would never be collected.

\(m\). The estimated bad debt rate used by the company was 2 percent of net credit sales.

Required:

1. Using the following categories, indicate the dollar effect (+ for increase, - for decrease, and NE for no effect) of each listed transaction, including the write-off of the uncollectible account and the adjusting entry for estimated bad debts (ignore the cost of sales). The effects of the first transaction are shown as an example.

\begin{tabular}{|l|c|c|c|}

\hline Sales Revenue & \begin{tabular}{c}

Sales Discounts \\

(taken)

\end{tabular} & \begin{tabular}{c}

Sales Returns and \\

Allowances \end{tabular} & Bad Debt Expense \\

\hline

a. \(\$ 128,000\) & NE & NE & NE \\

\hline \end{tabular}

2. Show how the accounts related to the preceding sale and collection activities should be reported on the income statement for 2011. (Treat sales discounts as contra revenues.)

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby