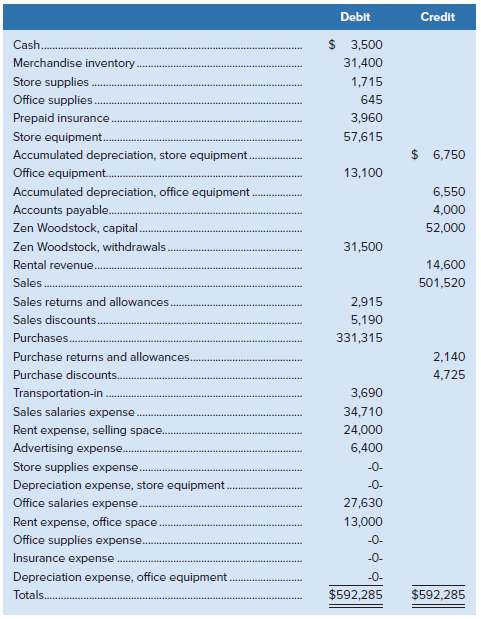

Information from the December 31, 2020, year-end unadjusted trial balance of Woodstock Store is as follows: Additional

Question:

Information from the December 31, 2020, year-end unadjusted trial balance of Woodstock Store is as follows:

Additional information:a. The balance on January 1, 2020, in the Store Supplies account was $480. During the year, $1,235 of store supplies were purchased and debited to the Store Supplies account. A physical count on December 31, 2020, shows an ending balance of $180.

b. The balance on January 1, 2020, in the Office Supplies account was $50. Office supplies of $595 were purchased in 2020 and added to the Office Supplies account. An examination of the office supplies at yearend revealed that $590 had been used.

c. The balance in the Prepaid Insurance account represents a policy purchased on September 1, 2020; it was valid for 12 months from that date.

d. The store equipment was originally estimated to have a useful life of 12 years and a residual value of $3,615.

e. When the office equipment was purchased, it was estimated that it would last four years and have no residual value.

f. Ending merchandise inventory, $29,000.

Required

Analyze and determine the impact of the adjustments from (a) to (f) on the unadjusted trial balance numbers. Prepare a classified multiple-step income statement like Exhibit 5A.2 using your adjusted trial balance numbers.

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann