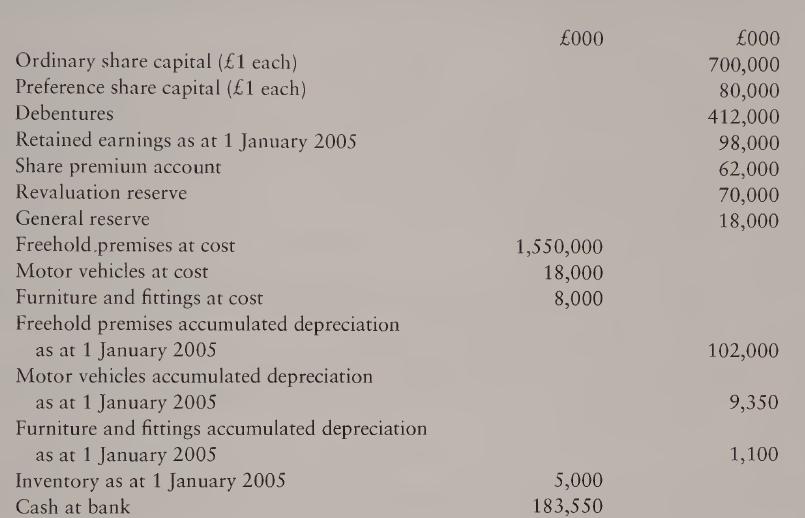

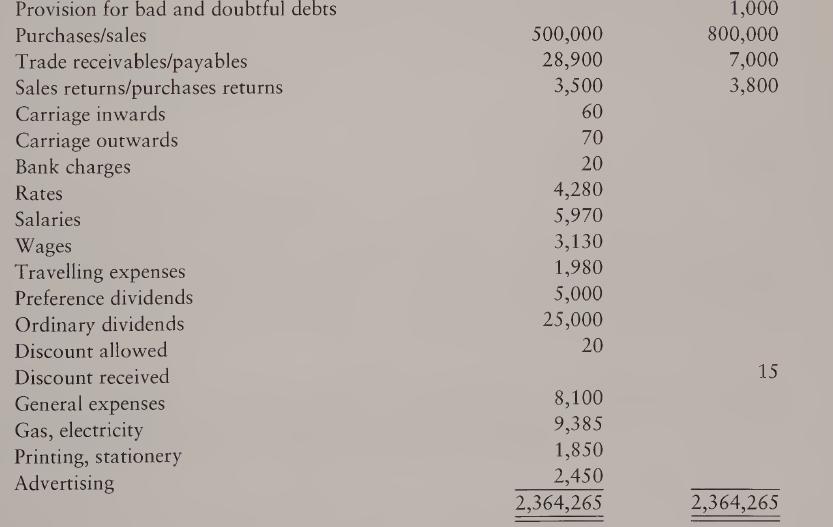

The following trial balance was extracted from the hooks of Leisureplay pic for the year ended 31

Question:

The following trial balance was extracted from the hooks of Leisureplay pic for the year ended 31 December 2005.

(a) Inventory as at 31 December 2005 is £12,000

(b) Depreciation is to be charged as follows:

(i) Freehold premises 2 % on cost (ii) Motor vehicles 10% on cost (iii) Furniture and fittings 5 % on cost

(c) There is the following payment in advance:

General expenses £500

(d) There are the following accrued expenses:

Business rates £300 Advertising £550 Auditors’ fees £250

(e) Authorised ordinary share capital is £1,000,000 £1 shares, and authorised preference share capital is 100,000 £1 shares.

(f) Taxation has been calculated as £58,500.

(g) Debenture interest should be charged at 10 %.

(h) Provision for bad and doubtful debts is increased to £1,600 and a bad debt of £400 is to be written off.

(i) The ordinary and preference dividends should be deducted from retained earnings.

Required: Prepare for internal management purposes the income statement for Leisureplay pic for the year ended 31 December 2005 and balance sheet as at 31 December 2005 using International Financial Reporting Standards.

Step by Step Answer: