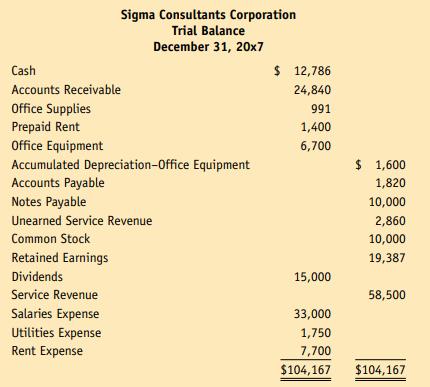

The schedule at the top of the opposite page presents the trial balance for Sigma Consultants Corporation

Question:

The schedule at the top of the opposite page presents the trial balance for Sigma Consultants Corporation on December 31, 20x7. The following information is also available:

a. Ending inventory of office supplies, $86.

b. Prepaid rent expired, $700.

c. Depreciation of office equipment for the period, $600.

d. Interest accrued on the note payable, $600.

e. Salaries accrued at the end of the period, $200.

f. Service revenue still unearned at the end of the period, $1,410.

g. Service revenue earned but not billed, $600.

h. Estimated federal income taxes for the period, $3,000.

Required 1. Open T accounts for the accounts in the trial balance plus the following:

Interest Payable; Salaries Payable; Income Taxes Payable; Office Supplies Expense; Depreciation Expense–Office Equipment; Interest Expense; and Income Taxes Expense. Enter the account balances.

2. Determine the adjusting entries and post them directly to the T accounts.

3. Prepare an adjusted trial balance.

4. User insight: What financial statements do each of the above adjustments affect? What financial statement is not affected by the adjustments?

Step by Step Answer: