Question:

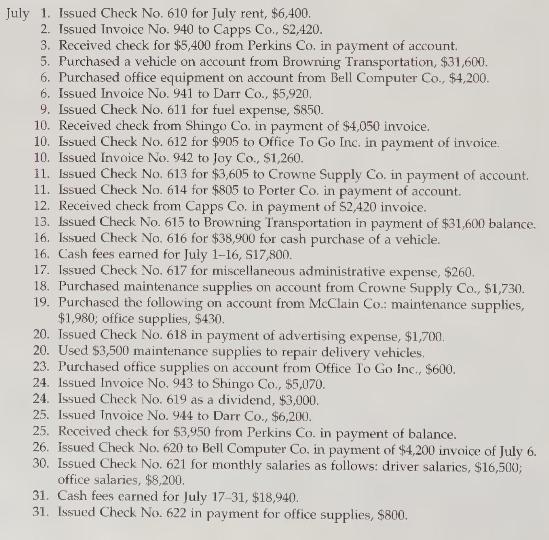

The transactions completed by Lightening Express Delivery Company during July 2008, the first month of the fiscal year, were as follows:

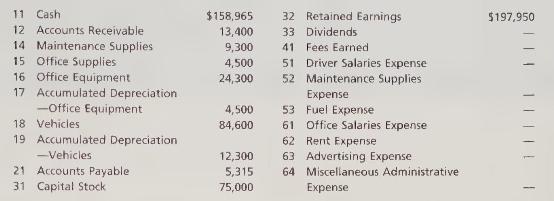

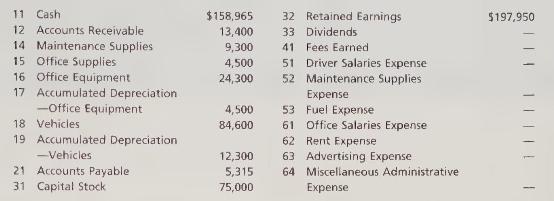

Instructions 1. Enter the following account balances in the general ledger as of July 1:

2. Journalize the transactions for July 2008, using the following journals similar to those illustrated in this chapter: cash receipts journal, purchases journal (with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), singlecolumn revenue journal, cash payments journal, and two-column general journal. Assume that the daily postings to the individual accounts in the accounts payable ledger and the accounts receivable ledger have been made.

3. Post the appropriate individual entries to the general ledger.

4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances.

5. Prepare an unadjusted trial balance.

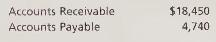

6. Verify the agreement of each subsidiary ledger with its control account. The sum of the balances of the accounts in the subsidiary ledgers as of July 31 are:objs. 2, 3

Transcribed Image Text:

July 1. Issued Check No. 610 for July rent, $6,400. 2. Issued Invoice No. 940 to Capps Co., S2,420. 3. Received check for $5,400 from Perkins Co. in payment of account. 5. Purchased a vehicle on account from Browning Transportation, $31,600. 6. Purchased office equipment on account from Bell Computer Co., $4,200. 6. Issued Invoice No. 941 to Darr Co., $5,920, 9. Issued Check No. 611 for fuel expense, $850. 10. Received check from Shingo Co. in payment of $4,050 invoice. 10. Issued Check No. 612 for $905 to Office To Go Inc. in payment of invoice. 10. Issued Invoice No. 942 to Joy Co., $1,260. 11. Issued Check No. 613 for $3,605 to Crowne Supply Co. in payment of account. 11. Issued Check No. 614 for $805 to Porter Co. in payment of account. 12. Received check from Capps Co. in payment of 52,420 invoice. 13. Issued Check No. 615 to Browning Transportation in payment of $31,600 balance. 16. Issued Check No. 616 for $38,900 for cash purchase of a vehicle. 16. Cash fees earned for July 1-16, S17,800. 17. Issued Check No. 617 for miscellaneous administrative expense, $260. 18. Purchased maintenance supplies on account from Crowne Supply Co., $1,730. 19. Purchased the following on account from McClain Co.: maintenance supplies, $1,980; office supplies, $430. 20. Issued Check No. 618 in payment of advertising expense, $1,700. 20. Used $3,500 maintenance supplies to repair delivery vehicles. 23. Purchased office supplies on account from Office To Go Inc., $600. 24. Issued Invoice No. 943 to Shingo Co., $5,070. 24. Issued Check No. 619 as a dividend, $3,000. 25. Issued Invoice No. 944 to Darr Co., $6,200. 25. Received check for $3,950 from Perkins Co. in payment of balance. 26. Issued Check No. 620 to Bell Computer Co. in payment of $4,200 invoice of July 6. 30. Issued Check No. 621 for monthly salaries as follows: driver salaries, $16,500; office salaries, $8,200. 31. Cash fees earned for July 17-31, $18,940. 31. Issued Check No. 622 in payment for office supplies, $800.

![]()