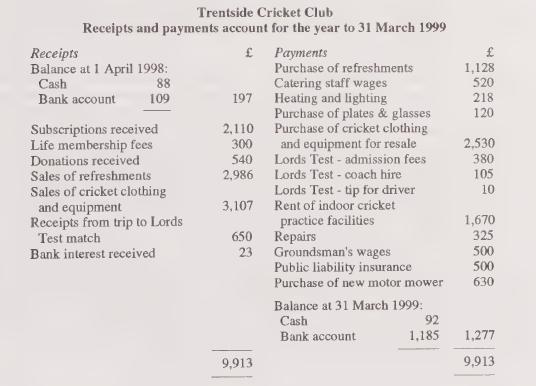

The treasurer of the Trentside cricket club has prepared the following receipts and payments account for the

Question:

The treasurer of the Trentside cricket club has prepared the following receipts and payments account for the year to 31 March 1999:

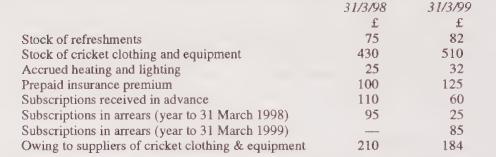

The following information is also relevant:

(a) The club owns its own ground and pavilion. The ground cost 2,000 and the pavilion was built at a cost of 1,400. Depreciation has not been charged on these assets in the past but it has now been decided that the pavilion should be depreciated at a rate of 5% per annum on the straight- line basis, beginning in the year to 31 March 1999.

(b) The new mower was bought for 900, less a part-exchange allowance of 270 on the old mower. Mowers are depreciated at 20% per annum on the straight-line basis, with a full charge in the year of acquisition and none in the year of disposal. The old mower had a written-down value of 310 on 31 March 1998.

(c) Apart from the ground, the pavilion, the mowers and the cash and bank balances, the assets and liabilities of the club are as follows:

(d) The policy of the club is to show subscriptions in arrears as an asset in the balance sheet so long as they relate to the accounting period which has just ended rather than to an earlier accounting period.

(e) Life membership of the club is available at a fee of 150. Life membership fees are transferred to the income and expenditure account over a period of ten years. As at 31 March 1998, the club had nine life members, six of whom had become life members within the previous nine years. The balance on the life membership account at 31 March 1998 was 420.

(f) It was decided on 1 April 1998 that a special fund should be established so that the club could acquire its own indoor practice facilities. All bank interest and all profits from the sale of cricket clothing and equipment are to be credited to this special fund until further notice. (g) 40% of heating and lighting costs and 60% of repairs relate to the preparation and sale of refreshments. The cost of the plates and glasses acquired during the year is to be written off immediately. None of the other expenses described above relate to the refreshments operation. Required: 1. Prepare a refreshments trading and profit and loss account for the year to 31 March 1999. 2. Prepare a cricket clothing and equipment trading account for the year to 31 March 1999. 3. Prepare an income and expenditure account for the year to 31 March 1999. 4. Prepare a balance sheet as at 31 March 1999.

Step by Step Answer: