Kevin, Kate and Kim are in partnership. Their partnership agreement states that: (a) partners are entitled to

Question:

Kevin, Kate and Kim are in partnership. Their partnership agreement states that:

(a) partners are entitled to 6% p.a. interest on their capital accounts

(b) interest is charged on partners’ drawings at the rate of 8% p.a.

(c) partners’ annual salaries are Kevin £4,000, Kate £7,000, Kim £11,000

(d) remaining profits and losses are shared in the ratio 8:7:5.

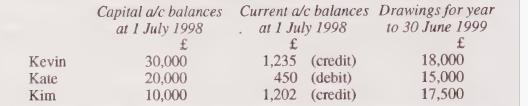

The partners’ capital and current account balances at 1 July 1998 and their drawings for the year to 30 June 1999 were as follows:

On 1 April 1999, Kevin reduced his capital by £8,000. He withdrew only £3,000 of this sum, leaving the remainder as a loan to the partnership, bearing interest at 10% p.a. This loan interest is to be credited to his current account.

On the same date, Kim increased her capital by a further £7,000.

The net profit for the year to 30 June 1999, before interest, was £82,410.

Required:

Prepare an appropriation account for the year to 30 June 1999 and write up the partners’ capital accounts and current accounts for the year. (For the purposes of calculating interest on drawings, it is assumed that all drawings were made on a date falling exactly half-way through the accounting year).

Step by Step Answer: