Liam and Lorna have been in partnership for many years, sharing profits in the ratio 3:2. On

Question:

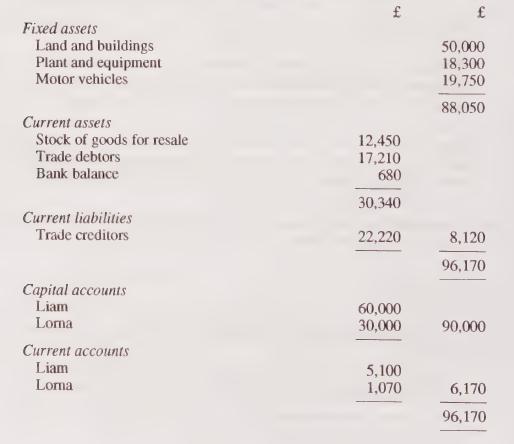

Liam and Lorna have been in partnership for many years, sharing profits in the ratio 3:2. On 31 October 2000 they agree to admit Len as a partner. Len will introduce capital of £15,000 and the new partnership of Liam, Lorna and Len will share profits in the ratio 4:3:1. The partnership balance sheet on 31 October 2000 is as follows:

It is agreed that the market values of the partnership's assets on 31 October 2000 are Goodwill £40,000, Land & buildings £95,000, Plant & equipment £20,000, Motor vehicles £15,000, Stock £11,500 and Debtors £16,430.

The partners wish to continue the practice of not showing goodwill in the balance sheet. Land & buildings are to remain in the balance sheet at historic cost, but all of the other assets are to be shown at their revalued amounts.

Required:

Make the necessary entries to record Len's admission to the partnership and prepare a revised balance sheet for the partnership.

Step by Step Answer: