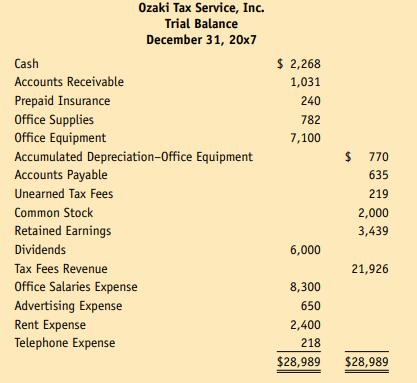

The trial balance for Financial Strategies Service, Inc., on December 31 is presented on the following page.

Question:

The trial balance for Financial Strategies Service, Inc., on December 31 is presented on the following page.

e. The services for all unearned tax fees had been performed by the end of the year.

f. Estimated federal income taxes for the year, $1,800.

Required 1. Open T accounts for the accounts in the trial balance plus the following:

Income Taxes Payable; Insurance Expense; Office Supplies Expense; Depreciation Expense–Office Equipment; and Income Taxes Expense. Record the balances shown in the trial balance.

2. Determine the adjusting entries and post them directly to the T accounts.

3. Prepare an adjusted trial balance, an income statement, a statement of retained earnings, and a balance sheet.

4. User insight: Why is it not necessary to show the effects of the above transactions on the statement of cash flows?

Determining Adjusting Entries and Tracing Their Effects to Financial Statements

Step by Step Answer: