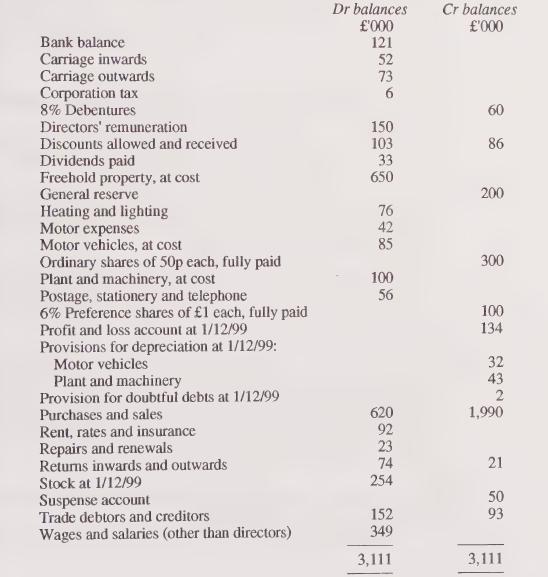

The trial balance of Devenish plc at 30 November 2000 (in alphabetical order and shown to the

Question:

The trial balance of Devenish plc at 30 November 2000 (in alphabetical order and shown to the nearest £1,000) is as follows:

The following information is also available: 1. Freehold property is to be revalued at 1,000,000. 2. One of the company's motor vehicles (which had been acquired in July 1998 for 15,000) was part-exchanged for a new vehicle during the year. The new vehicle cost 23,000. A part-exchange allowance of 10,000 was granted in relation to the old vehicle and the balance of 13,000 was paid by cheque. This payment was debited to the motor vehicles account and credited to the bank account. No other entry was made in relation to this transaction. 3. The company calculates depreciation on the straight-line basis at 10% p.a. for plant and machinery and at 20% p.a. for motor vehicles, with a full charge in the year of acquisition and none in the year of disposal. None of the plant and machinery or motor vehicles had been fully depreciated by 30 November 1999. 4. Accrued electricity charges on 30 November 2000 are estimated at 11,000 and accrued telephone charge are estimated to be 5,000. Rent of 3,000 has been paid in advance. The last rates bill paid during the year was for 12,000 and covered the six months to 31 March 2001. Insurance premiums of 18,000 for the year to 31 May 2001 were paid on 2 June 2000. 5. Closing stock at 30 November 2000 is valued at 282,000. 6. Bad debts of 2,000 are to be written off and the provision for doubtful debts is to be adjusted to 2% of the remaining trade debtors. 7. All of the 8% Debentures were issued on 1 July 2000 and are redeemable after 10 years. No debenture interest has yet been paid or accounted for. 8. The audit fee for the year is estimated to be 10,000. 9. The balance of 6,000 on the corporation tax account is the difference between the estimated liability for the year to 30 November 1999 and the amount actually paid on 1 September 2000. The estimated liability for the year to 30 November 2000 is 125,000.10. 20,000 ordinary shares were issued in November 2000 at an issue price of 2.50 per share. The proceeds of 50,000 were debited to the bank account and credited to a suspense account. No other entries were made in relation to this share issue. 11. 120,000 is to be transferred to the general reserve. 12. Dividends paid during the year consist of the first half-year's dividend on the preference shares and an interim dividend of 5p per share on the ordinary shares. The interim dividend was paid before the new issue (see above) was made. The directors propose that the remaining half-year's dividend should be paid on the preference shares and that a final dividend of 10p per share should be paid on the ordinary shares. Required:

(a) Prepare a trading and profit and loss account and an appropriation account for the year to 30 November 2000.

(b) Prepare a balance sheet as at 30 November 2000.

Step by Step Answer: