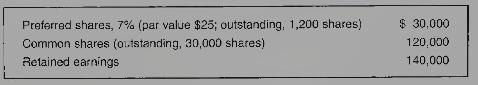

Water Tower Company had the following shares outstanding and retained earnings at December 31, 2011: The board

Question:

Water Tower Company had the following shares outstanding and retained earnings at December 31, 2011:

The board of directors is considering the distribution of a cash dividend to the two groups of shareholders. No dividends were declared during 2009 or 2010 . Three independent cases are assumed:

Case A: The preferred shares are non-cumulative; the total amount of dividends is \(\$ 15,000\).

Case B: The preferred shares are cumulative; the total amount of dividends is \(\$ 6,300\).

Case C: Same as Case B, except the amount is \(\$ 33,000\).

\section*{Required:}

1. Compute the amount of dividends, in total and per share, that would be payable to each class of shareholders for each case. Show computations.

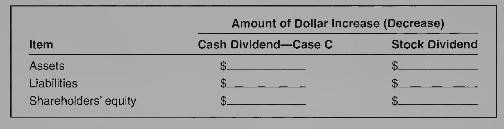

2. Assume that the company issued a 10 percent common stock dividend on the outstanding common shares when the market value per share was \(\$ 24\). Complete the following comparative schedule, including explanation of the differences.

Step by Step Answer:

Financial Accounting

ISBN: 9780070001497

4th Canadian Edition

Authors: Patricia A. Libby, Daniel Short, George Kanaan, Maureen Libby Gowing, Robert Libby