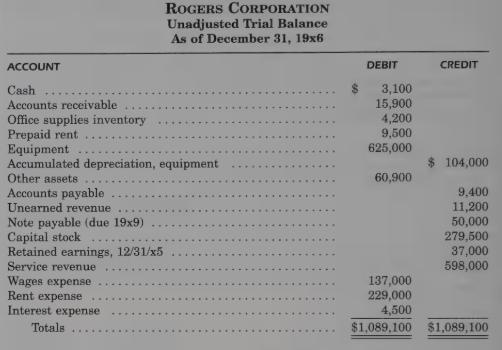

You have the following unadjusted trial balance (illustrated in Chapter 3) for Rogers Corporation at December 31,

Question:

You have

the following unadjusted trial balance (illustrated in Chapter 3) for Rogers Corporation

at December 31, 19x6:

At year-end, you have the following data for adjustments:

a) An analysis indicates that prepaid rent on December 31 should be $7,900.

b) A physical inventory shows that $1,100 of office supplies is on hand.

c) The equipment is being depreciated over an expected life of 7 years with a residual

value of $30,000. Straight-line depreciation is used.

d) An analysis indicates that unearned revenue should be $8,400.

e) Wages in the amount of $2,800 are owed but unpaid and unrecorded at year-end.

f) Six months’ interest at 9% on the note was paid on September 30. Interest for the

period from October 1 to December 31 is unpaid and unrecorded.

g) Income taxes at 30% are owed but unrecorded and unpaid.

REQUIRED:

1. Prepare the adjusting entries.

2. Prepare an income statement, a statement of changes in retained earnings, and a

balance sheet using adjusted account balances.

Step by Step Answer: