Amit is a limited partner in Reynolds Partnership. This year, Amits Schedule K-1 from Reynolds reflected $50,000

Question:

Amit is a limited partner in Reynolds Partnership. This year, Amit’s Schedule K-1 from Reynolds reflected $50,000 of ordinary income, $1,000 of interest income, and a cash distribution of $35,000. Amit’s marginal tax rate is 37 percent. Amit qualifies for the QBI deduction, without regard to the wage or taxable income limitations.

a. Calculate the tax cost of Amit’s partnership earnings this year.

b. Calculate Amit’s after-tax cash flow from his partnership activity this year.

Transcribed Image Text:

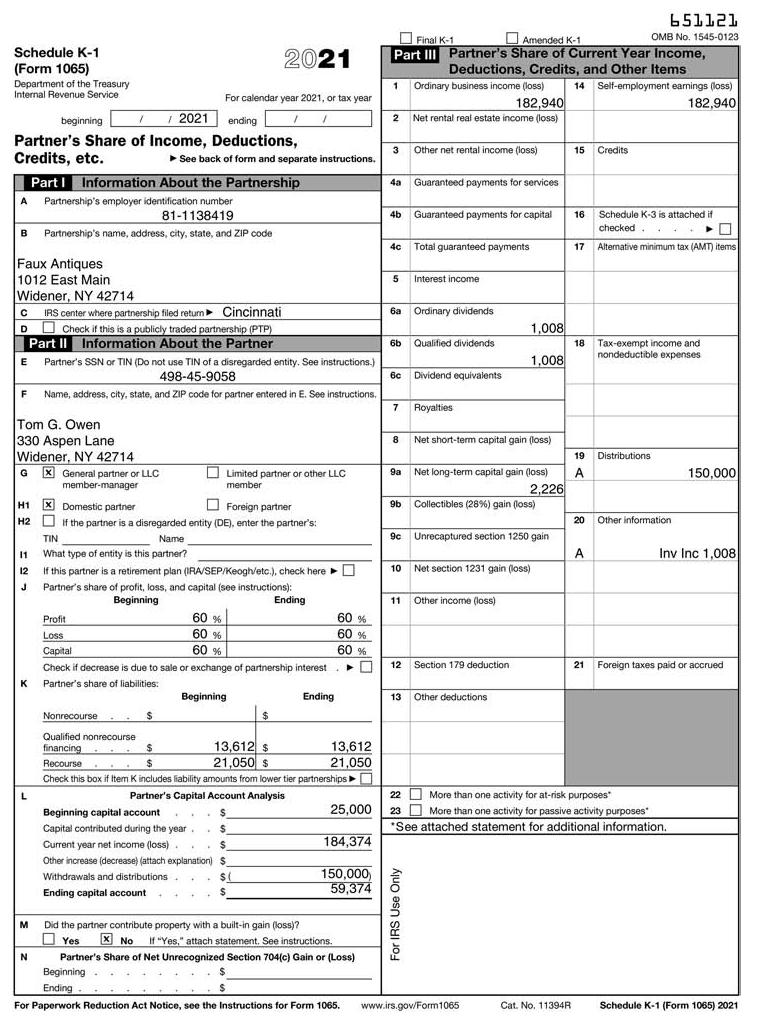

Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service 1 / 2021 ending Partner's Share of Income, Deductions, Credits, etc. Faux Antiques 1012 East Main Part I Information About the Partnership A Partnership's employer identification number 81-1138419 B Partnership's name, address, city, state, and ZIP code E Widener, NY 42714 C IRS center where partnership filed retum Cincinnati I D Check if this is a publicly traded partnership (PTP) Part II Information About the Partner beginning Tom G. Owen 330 Aspen Lane Partner's SSN or TIN (Do not use TIN of a disregarded entity. See instructions.) 498-45-9058 F Name, address, city, state, and ZIP code for partner entered in E. See instructions. Widener, NY 42714 GX General partner or LLC member-manager H1 H2 11 12 K M N ► See back of form and separate instructions. For calendar year 2021, or tax year / 1 TIN Name What type of entity is this partner? Domestic partner Foreign partner If the partner is a disregarded entity (DE), enter the partner's: 2021 60 % 60 % 60 % $ If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here ► Partner's share of profit, loss, and capital (see instructions): Beginning Limited partner or other LLC member Profit Loss Capital Check if decrease is due to sale or exchange of partnership interest Partner's share of liabilities: Beginning . Beginning capital account Capital contributed during the year $ 8 Current year net income (loss). $ Other increase (decrease) (attach explanation) S Withdrawals and distributions $( $ Ending capital account . Partner's Capital Account Analysis $ Y Ending Nonrecourse Qualified nonrecourse financing $ 13,612 $ 21,050 $ Recourse $ Check this box if Item K includes liability amounts from lower tier partnerships . $ $ Ending 60 % 60 % 60 % ➤ 0 13,612 21,050 25,000 184,374 150,000) 59,374 Did the partner contribute property with a built-in gain (loss)? Yes No If "Yes," attach statement. See instructions. Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning Ending For Paperwork Reduction Act Notice, see the Instructions for Form 1065. Final K-1 Amended K-1 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items 1 2 3 4a 4b 4c 5 6b 7 8 6a Ordinary dividends Ordinary business income (loss) 182,940 Net rental real estate income (loss) 11 Other net rental income (loss) 6c Dividend equivalents 12 Guaranteed payments for services 13 Guaranteed payments for capital Total guaranteed payments Interest income For IRS Use Only Qualified dividends Royalties 9a Net long-term capital gain (loss) 2,226 9b Collectibles (28%) gain (loss) 9c Unrecaptured section 1250 gain 10 Net section 1231 gain (loss) Net short-term capital gain (loss) 1,008 Other income (loss) 1,008 Section 179 deduction Other deductions www.irs.gov/Form1065 14 Self-employment earnings (loss) 182,940 15 Credits 16 17 18 651121 OMB No. 1545-0123 Schedule K-3 is attached if checked Alternative minimum tax (AMT) items 19 Distributions A A Tax-exempt income and nondeductible expenses 20 Other information. 22 More More than one activity for at-risk purposes 23 More than one activity for passive activity purposes *See attached statement for additional information. 150,000 Inv Inc 1,008 21 Foreign taxes paid or accrued Cat. No. 11394R Schedule K-1 (Form 1065) 2021

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

a 15170 50000 ordinary in...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted:

Students also viewed these Business questions

-

Kari is a limited partner in Lizard Partnership. This year, Karis share of partnership ordinary income is $20,000, and she received a cash distribution of $30,000. Karis tax basis in her partnership...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Rochelle is a limited partner in Megawatt Partnership. For 2022, her Schedule K-1 from the partnership reported the following share of partnership items: a. Calculate the net impact of the given...

-

Steve and Linda Hom live in Bartlesville, Oklahoma. Two years ago, they visited Thailand. Linda, a professional chef, was impressed with the cooking methods and the spices used in the Thai food....

-

List some of the more analytical functions performed by professional accountants.

-

Which of Webers and Fayols principles seem most relevant to the creation of an ethical organization?

-

Calculating Simple Interest on a Loan. You can buy an item for $100 on a charge with the promise to pay $100 in 90 days. Suppose you can buy an identical item for $95 cash. If you buy the item for...

-

Arnez Company's annual accounting period ends on December 31, 2017. The following information concerns the adjusting entries to be recorded as of that date. (Entries can draw from the following...

-

FarCry Industries, a maker of telecommunications equipment, has 3 million shares of common stock outstanding, 1 million shares of preferred stock outstanding, and 10,000 bonds. Suppose the common...

-

In 2021, Bartley Corporations federal income tax due was $147,000. Compute the required installment payments of 2022 tax in each of the following cases: a. Bartleys 2022 taxable income is $440,000....

-

Hallick, Inc. has a fiscal year ending June 30. Taxable income was $5,000,000 for its year ended June 30, 2018, and it projects similar taxable income for its 2022 fiscal year. a. Compute Hallicks...

-

New research shows that many banks are unwittingly training their online customers to take risks with their passwords and other sensitive account information, leaving them more vulnerable to fraud...

-

You have recently taken over daycare center that was under substandard leadership. Currently, the staff is unmotivated, negative, and often absent from work. You notice that there is minimal...

-

Choose an organization from the industry of your choice to discuss, illustrate, and reflect deliberately on the following: Why is it important to distinguish between "group" and "team "? What kinds...

-

The focus of data governance programs, in some capacity, is enterprise-wide data quality standards and processes. If you were a manager focusing on master data: Would you likely meet enterprise-level...

-

1) Identify and explain each component of the ANOVA model. 2) How is the F ratio obtained? 3) What role does the F ratio play?

-

Make a BCG matrix table and place the following products from Apple: iPhone, iPad, iMac, iPod, Apple TV, Apple Watch, AirPod, and HomePod. Briefly describe why you have placed the products in the...

-

Design Extravaganza Ltd. designs and retails formal wear sold in stores in North America, Asia, and Europe. Selected financial data (in thousands) for recent years are as follows: Instructions 1....

-

In your audit of Garza Company, you find that a physical inventory on December 31, 2012, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items...

-

For 2023, Ms. Deming earned wages totaling $225,000. Calculate any .9 percent additional Medicare tax owed, assuming that. a. Ms. Deming is single. b. Ms. Deming files a joint return with her husband...

-

In 2023, Wilma Ways sole proprietorship, WW Bookstore, generated $120,000 net profit. In addition, Wilma recognized a $17,000 Section 1231 gain on the sale of business furniture. The business...

-

Calculate the total Social Security and Medicare tax burden on a sole proprietorship earning 2023 profit of $300,000, assuming a single sole proprietor with no other earned income.

-

ABC Corporation has an activity - based costing system with three activity cost pools - Machining, Setting Up , and Other. The company's overhead costs, which consist of equipment depreciation and...

-

Consolidated Balance Sheets - USD ( $ ) $ in Thousands Dec. 3 1 , 2 0 2 3 Dec. 3 1 , 2 0 2 2 Current assets: Cash and cash equivalents $ 9 8 , 5 0 0 $ 6 3 , 7 6 9 Restricted cash 2 , 5 3 2 Short -...

-

How does corporate governance contribute to investor confidence and stakeholder trust? Accounting

Study smarter with the SolutionInn App