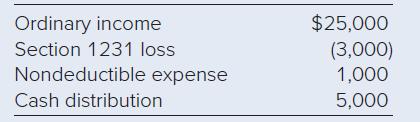

Rochelle is a limited partner in Megawatt Partnership. For 2022, her Schedule K-1 from the partnership reported

Question:

Rochelle is a limited partner in Megawatt Partnership. For 2022, her Schedule K-1 from the partnership reported the following share of partnership items:

a. Calculate the net impact of the given items on Rochelle’s 2022 taxable income. Assume that Rochelle does not qualify for the QBI deduction.

b. Assume that Rochelle’s marginal tax rate is 35 percent. Calculate her 2022 after-tax cash flow as a result of her interest in Megawatt.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted: