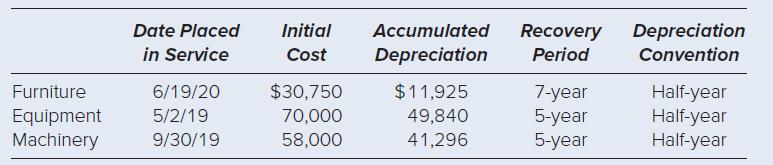

At the beginning of its 2022 tax year, Hiram owned the following business assets: On July 8,

Question:

At the beginning of its 2022 tax year, Hiram owned the following business assets:

On July 8, Hiram sold its equipment. On August 18, it purchased and placed in service new tools costing $589,000; these tools are three-year recovery property. These were Hiram’s only capital transactions for the year. Compute Hiram’s maximum cost recovery deduction for 2022. In making your computation, assume that taxable income before depreciation exceeds $2,000,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted: