Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use Schedule SE, Form

Question:

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use Schedule SE, Form 1040, to compute her 2021 self-employment tax and her income tax deduction for such tax.

a. Mrs. Singer’s net profit from Schedule C was $51,458. She had no other earned income.

b. Mrs. Singer’s net profit from Schedule C was $51,458, and she received a $110,000 salary from an employer.

c. Mrs. Singer’s net profit from Schedule C was $51,458, and she received a $155,000 salary from an employer.

Transcribed Image Text:

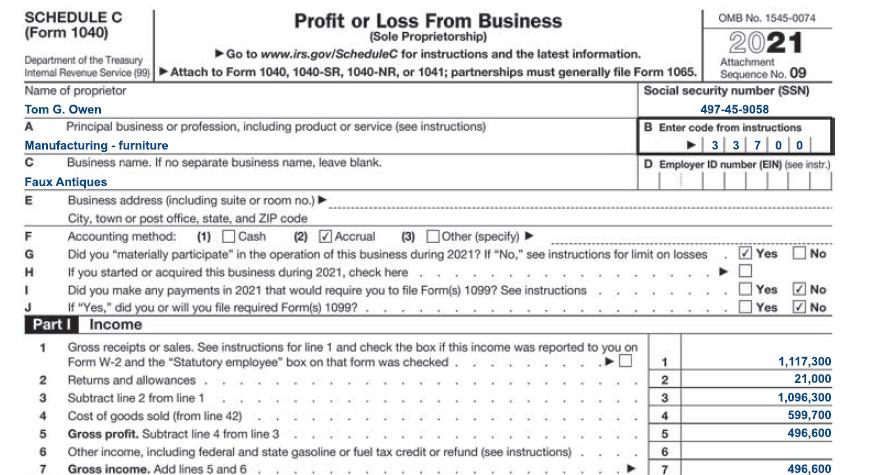

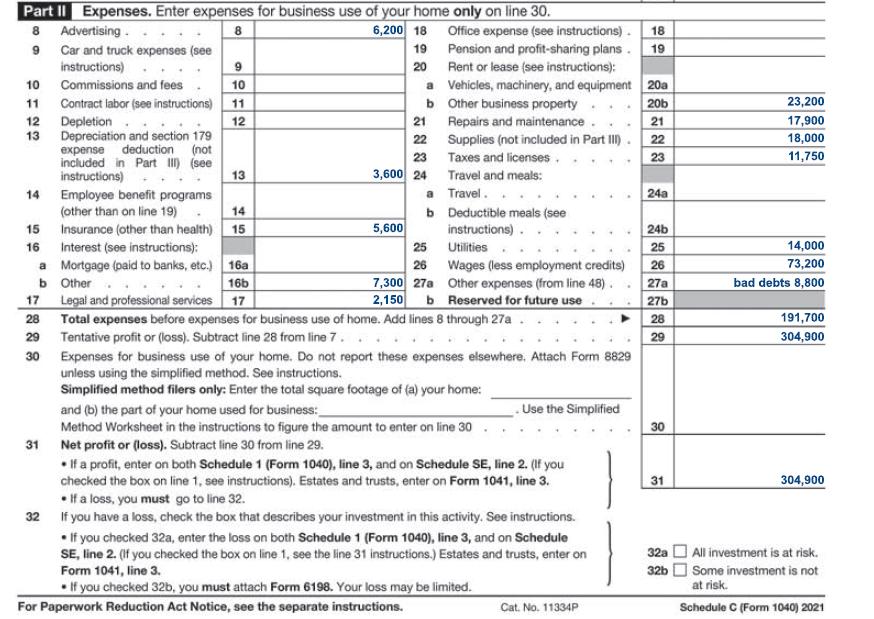

SCHEDULE C (Form 1040) ►Go to www.irs.gov/ScheduleC for instructions and the latest information. Department of the Treasury Internal Revenue Service (99) ► Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships must generally file Form 1065. Social security number (SSN) Name of proprietor Tom G. Owen A Principal business or profession, including product or service (see instructions) Manufacturing - furniture с Business name. If no separate business name, leave blank. Faux Antiques E F G 1 Part I Profit or Loss From Business (Sole Proprietorship) 2 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. Returns and allowances. Subtract line 2 from line 1 Cost of goods sold (from line 42) Gross profit. Subtract line 4 from line 3 3 4 5 6 7 Business address (including suite or room no.) ► City, town or post office, state, and ZIP code Accounting method: (1) Cash (2) Accrual (3) Other (specify) Did you "materially participate in the operation of this business during 2021? If "No," see instructions for limit on losses If you started or acquired this business during 2021, check here Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions If "Yes," did you or will you file required Form(s) 1099?. Income Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) Gross income. Add lines 5 and 6 497-45-9058 B Enter code from instructions 33700 D Employer ID number (EIN) (see instr.) 1 2 OMB No. 1545-0074 2021 3₂ 4 5 6 7 Attachment Sequence No. 09 SO Yes No Yes Yes No No 1,117,300 21,000 1,096,300 599,700 496,600 496,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 37% (8 reviews)

a Mrs Singers 2021 selfemployment tax is 7271 and her income tax deduction is 3635 b Mrs Singers 2021 selfemployment tax is 5445 and her income tax deduction is 2723 c Mrs Singers 2021 selfemployment ...View the full answer

Answered By

Irfan Ali

I have a first class Accounting and Finance degree from a top university in the World. With 5+ years experience which spans mainly from the not for profit sector, I also have vast experience in preparing a full set of accounts for start-ups and small and medium-sized businesses. My name is Irfan Ali and I am seeking a wide range of opportunities ranging from bookkeeping, tax planning, business analysis, Content Writing, Statistic, Research Writing, financial accounting, and reporting.

4.70+

249+ Reviews

530+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted:

Students also viewed these Business questions

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use a Schedule SE, Form 1040, to compute her 2014 self-employment tax and her income tax deduction for such tax. a....

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use a Schedule SE, Form 1040, to compute her 2016 self-employment tax and her income tax deduction for such tax. a....

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use a Schedule SE, Form 1040, to compute her 2017 self-employment tax and her income tax deduction for such tax. a....

-

A partially completed flowchart showing some of the major documents commonly used in the purchasing function of a merchandise business is presented below. Identify documents 1, 3, and4. Purchase Order

-

Baker Construction is a small corporation owned and managed by Tom Baker. The corporation has 21 employees, few creditors, and no investor other than Tom Baker. Thus, like many small businesses, it...

-

A container at a pressure p and temperature T contains two substances 1 and 2, present both in liquid and gas phases. Estimate the partial pressure p A of substance Entropy of mixing, as a function...

-

Using Current Information on Obtaining the Best Credit Terms. Choose a current issue of Money, Kiplingers Personal Finance Magazine, or Bloomberg Businessweek and summarize an article that provides...

-

The manager of Collins Import Autos believes the number of cars sold in a day (Q) depends on two factors: (1) the number of hours the dealership is open (H) and (2) the number of salespersons working...

-

The incremental manufacturing cost that the company will incur if it increases production from 10,000 to 10,001 units is closest to: Multiple Choice $15.15 $13.95 $1165 $16.45

-

At the beginning of 2022, Ms. Pope purchased a 20 percent interest in PPY Partnership for $20,000. Ms. Popes Schedule K-1 reported that her share of PPYs debt at year-end was $12,000, and her share...

-

Refer to the facts in the preceding problem. a. Complete Schedule K, Form 1065, for the partnership. b. Complete Schedule K-1, Form 1065, for Jayanthi. Data from Application Problems 21: Jayanthi and...

-

On the basis of the empirical evidence presented in this chapter and in Chapter 3 (i. e., MD& A, Section 3.6), do you feel the Conceptual Framework (Section 3.7.1) is correct in its claim that the...

-

This case study is based on a fictional character on NBC's The Office. Michael is the central character of the series, serving as the Regional Manager of the Scranton branch of a paper distribution...

-

What is the significance of a balance sheet in understanding a firm's financial position? How do changes on the right side of the balance sheet (liabilities and equity) impact a company's financial...

-

A current event analysis where the article must focus on a management concepts). You will read the article and then provide an analysis of the subject matter discussed. The article should complement...

-

Given an exponential distribution with =20, what is the probability that the arrival time is a. less than X=0.2? b. greater than X = 0.2? c. between X=0.2 and X 0.3? d. less than X=0.2 or greater...

-

Choose at least two measures of employee attitudes. Discuss them and tell me about your discussion. Which group you believe are the most effective and efficient measures? Why? 2) Discuss turnover,...

-

Corby Distilleries Limited is a leading Canadian manufacturer and marketer of spirits and imported wines. Corby's portfolio of owned-brands includes some of the most renowned brands in Canada,...

-

Consider the reaction of acetic acid in water CH 3 CO 2 H(aq) + H 2 O(l) CH3CO 22 (aq) + H 3 O + (aq) where Ka 5 1.8 3 1025. a. Which two bases are competing for the proton? b. Which is the stronger...

-

Hummingbird Corporation, a closely held C corporation that is not a PSC, has $40,000 of net active income, $15,000 of portfolio income, and a $45,000 loss from a passive activity. Compute...

-

Compute the charitable contribution deduction (ignoring the percentage limitation) for each of the following C corporations. a. Amber Corporation donated inventory of clothing (basis of $24,000, fair...

-

Art, an executive with Azure Corporation, plans to start a part-time business selling products on the Internet. He will devote about 15 hours each week to running the business. Arts salary from Azure...

-

The following schedule reconciles Cele Co.'s pretax GAAP income Pretax GAAP income Nondeductible expense for fines Tax deductible depreciation in excess of GAAP depreciation expens Taxable rental...

-

How to solve general ledger cash balance chapter 9 assignment 5

-

On 31 July 2018, Sipho bought 1 000 ordinary shares in ABC Ltd at a cost of R2 750. On 31 December 2018 the company made a 1 for 10 bonus issue. On 31 March 2019, Sipho sold 300 shares for R800. What...

Study smarter with the SolutionInn App