Refer to the facts in the preceding problem. a. Complete Schedule K, Form 1065, for the partnership.

Question:

Refer to the facts in the preceding problem.

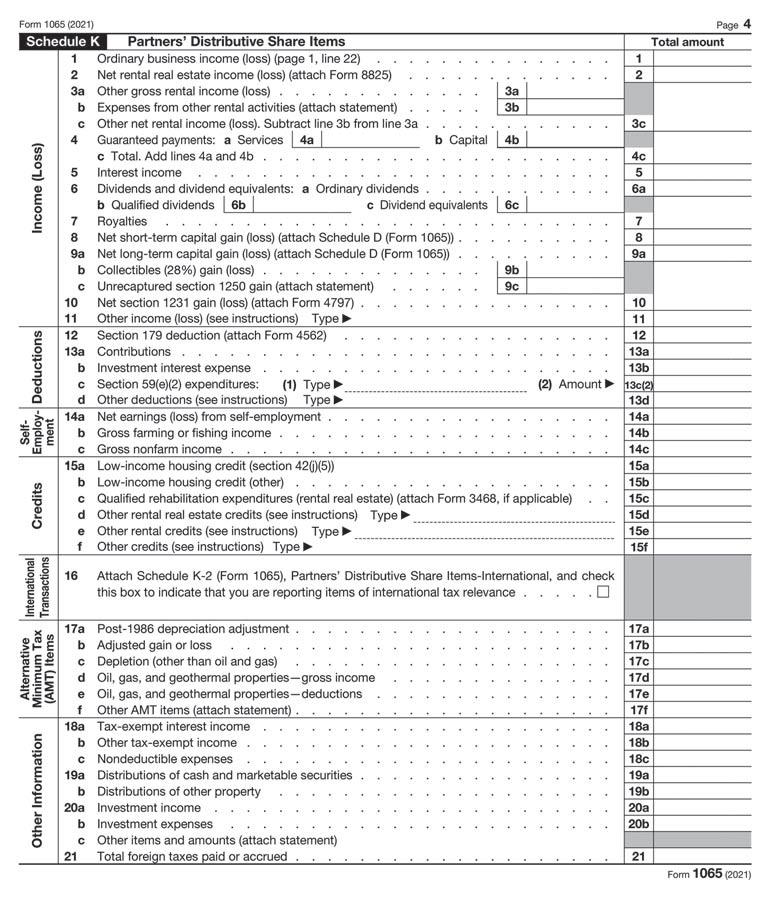

a. Complete Schedule K, Form 1065, for the partnership.

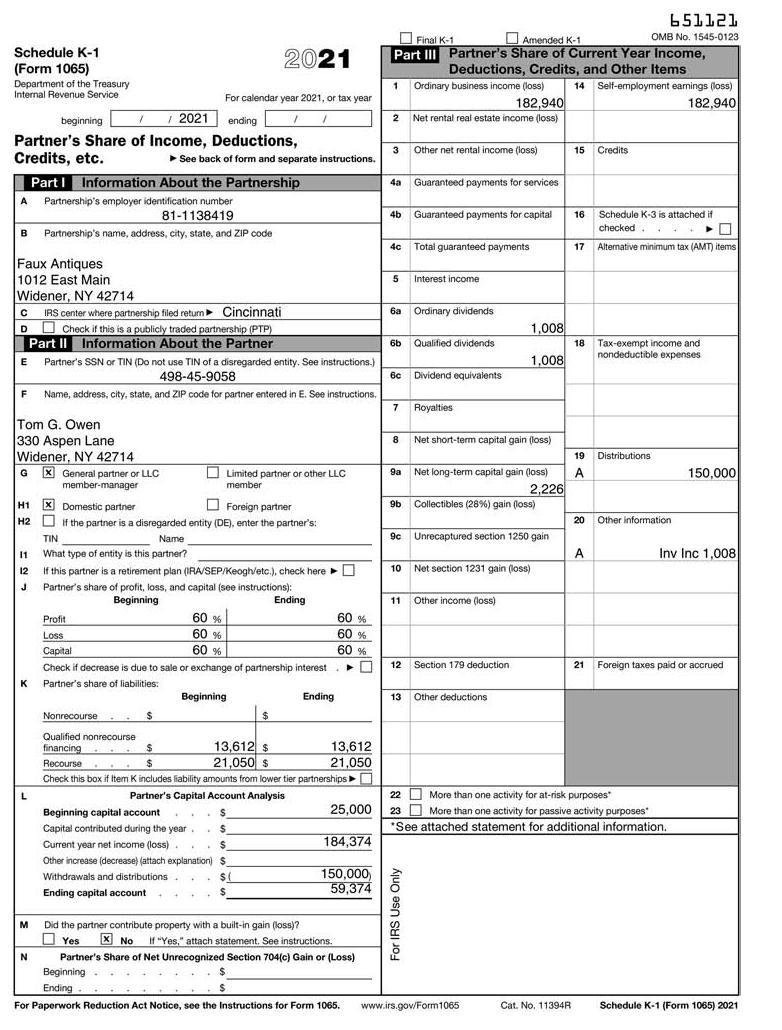

b. Complete Schedule K-1, Form 1065, for Jayanthi.

Data from Application Problems 21:

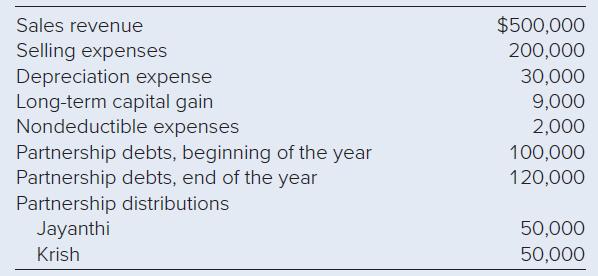

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnership’s 2021 activities:

Transcribed Image Text:

Form 1065 (2021) Schedule K Partners' Distributive Share Items Ordinary business income (loss) (page 1, line 22) Net rental real estate income (loss) (attach Form 8825) Other gross rental income (loss). Income (Loss) Employ- Deductions Self- ment Credits International Transactions Alternative Minimum Tax (AMT) Items Other Information 1 2 3a b Expenses from other rental activities (attach statement) c Other net rental income (loss). Subtract line 3b from line 3a 4 Guaranteed payments: a Services | 4a | 56 12 Section 179 deduction (attach Form 4562) 13a Contributions. 7 8 Net short-term capital gain (loss) (attach Schedule D (Form 1065)) 9a Net long-term capital gain (loss) (attach Schedule D (Form 1065)) b Collectibles (28%) gain (loss) c Unrecaptured section 1250 gain (attach statement) 10 Net section 1231 gain (loss) (attach Form 4797). 11 Other income (loss) (see instructions) Type c Total. Add lines 4a and 4b Interest income b Investment interest expense c Section 59(e)(2) expenditures: (1) Type d Other deductions (see instructions) Type ► Dividends and dividend equivalents: a Ordinary dividends. b Qualified dividends 6b| Royalties. 14a Net earnings (loss) from self-employment. b Gross farming or fishing income c Gross nonfarm income. 15a Low-income housing credit (section 42(j)(5)) b Low-income housing credit (other). 16 ... e Other rental credits (see instructions) Type ► f Other credits (see instructions) Type ► 17a d e Post-1986 depreciation adjustment. b Adjusted gain or loss c 20a c Qualified rehabilitation expenditures (rental real estate) (attach Form 3468, if applicable) d Other rental real estate credits (see instructions) Type ► Depletion (other than oil and gas) f 18a Tax-exempt interest income b Capital c Dividend equivalents Oil, gas, and geothermal properties-gross income Oil, gas, and geothermal properties-deductions Other AMT items (attach statement). b Other tax-exempt income c Nondeductible expenses 19a Distributions of cash and marketable securities b Distributions of other property Investment income b Investment expenses c Other items and amounts (attach statement) 21 Total foreign taxes paid or accrued 3a 3b 4b 6c Attach Schedule K-2 (Form 1065), Partners' Distributive Share Items-International, and check this box to indicate that you are reporting items of international tax relevance. 9b 9c 24 * (2) Amount I 1 2 3c 4c 6a 789 9a 10 11 12 13a 13b 13c(2) 13d 14a 14b 14c 15a 15b 15c 15d 15e 15f 17a 17b 17c 17d 17e 17f 18a 18b 18c 19a 19b 20a 20b 21 Page Total amount 4 Form 1065 (2021)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

a Schedule K b Jayanthis Schedule K1 Schedule K Income Loss Employ Deductions Self ment Credits Part...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted:

Students also viewed these Business questions

-

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnerships 2014 activities: Sales revenue $500,000...

-

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnership's 2016 activities: Sales revenue...

-

Jayanthi and Krish each own a 50 percent general partner interest in the JK Partnership. The following information is available regarding the partnerships 2021 activities: a. Calculate the...

-

31. Which combination of the compounds and their geometry are correct h) CIF, - V-shaped e) CIF, - Tshaped OB. a HeCl, - linoar 24. Which of the following havea bond angle smaller than tetrahodral...

-

Mr. Baskins, manager of Tom and Jerrys Ice Cream Shoppe, needs help scheduling servers for next week. Create a schedule that will meet the demand requirements given below and guarantee each server...

-

The Fischer esterification reaction is given by, Determine the equilibrium constant K of this reaction in terms of the concentrations of the reactants c R-(C=O)-OH , c R-OH and of the products c...

-

Using the Internet to Obtain Information about the Costs of Credit. As pointed out at the beginning of this chapter, credit costs money; therefore, you must conduct a cost/benefit analysis before...

-

Luke Gilbert is to retire from the partnership of Gilbert and Associates as of March 31, the end of the current fiscal year. After closing the accounts, the capital balances of the partners are as...

-

Viktor, who is from Russia, earned wages of $12,335 in 2022 . He had $280 withheld for state income taxes. He listed the state taxes as a deduction on his federal tax return in 2022 which lowered his...

-

Mrs. Singer owns a profitable sole proprietorship. For each of the following cases, use Schedule SE, Form 1040, to compute her 2021 self-employment tax and her income tax deduction for such tax. a....

-

Bangura, Inc. has accumulated minimum tax credits of $1.3 million from tax years prior to 2018. The following are Banguras regular tax before credits for 2018 through 2021. a. Complete the following...

-

To what extent do you believe that these changes increase the attractiveness of operational HR roles?

-

You have been employed as a systems analyst in the information systems organization of a medium-sized consumer goods manufacturer for three years. You are quite surprised when your manager offers you...

-

For your initial post, address the following: First, introduce yourself to the class by sharing a bit about yourself, such as your preferred name or pronouns, where you are from, what your major is,...

-

Question 8 : Consider the technology of Solar Panels. Which stage of the technology life cycle S curve is this technology in. Justify why ? Question 9 : The standard Product Life Cycle has 5 stages...

-

At Benihana restaurant a man wrenched his neck while ducking a piece of flying shrimp, requiring treatment by several doctors. By that summer, doctors determined surgery was necessary to treat...

-

You have just come into an inheritance of $25,000 from a distant relative, and you want to invest it for the long term. Provide an investment portfolio that includes five different stocks. Report the...

-

Andrew Peller Limited and Magnotta Winery Corporation are two producers of quality wines in Canada. Selected financial data (in thousands) for these two competitors for a recent year are as follows:...

-

Find the radius of convergence in two ways: (a) Directly by the CauchyHadamard formula in Sec. 15.2. (b) From a series of simpler terms by using Theorem 3 or Theorem 4.

-

Compute the income tax liability for each of the following unrelated C corporations. a. Darter Corporation has taxable income of $68,000. b. Owl Corporation has taxable income of $10,800,000. c....

-

In the current year, Wilson Enterprises, a calendar year taxpayer, suffers a casualty loss of $90,000. How much of the casualty loss will be deductible by Wilson under the following circumstances? a....

-

Benton Company (BC) has one owner, who is in the 33% Federal income tax bracket. BCs gross income is $395,000, and its ordinary trade or business deductions are $245,000. Compute the Federal income...

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

Study smarter with the SolutionInn App