Ms. Drake sold a business that she had operated as a sole proprietorship for 18 years. On

Question:

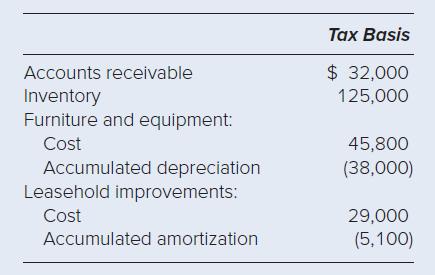

Ms. Drake sold a business that she had operated as a sole proprietorship for 18 years. On the date of sale, the business balance sheet showed the following assets:

The purchaser paid a lump-sum price of $300,000 cash for the business. The sales contract stipulates that the FMV of the business inventory is $145,000, and the FMV of the remaining balance sheet assets equals adjusted tax basis. Assuming that Ms. Drake’s marginal tax rate on ordinary income is 35 percent and her rate on capital gain is 15 percent, compute the net cash flow from the sale of her business.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Taxation For Business And Investment Planning 2023

ISBN: 9781264229741

26th Edition

Authors: Sally Jones, Shelley Rhoades-Catanach, Sandra Callaghan, Thomas Kubick

Question Posted: